- Crypto flash crash trim gains as cryptocurrencies bleed.

- Bitcoin seeks solace between $3,700 and $3,800 amid the selloff.

- Bitcoin expected to trend sideways between $3,700 and $3,800 core support.

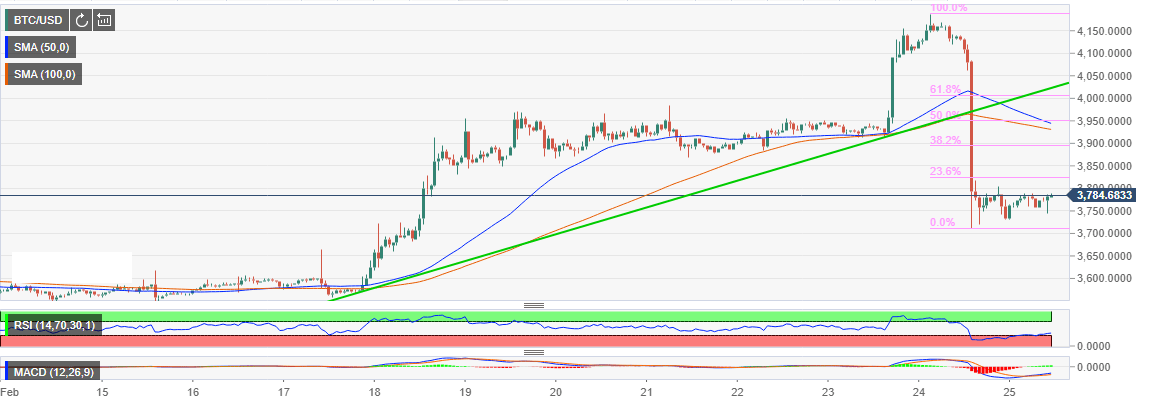

Bitcoin suffered under the rough arm of the bears on Sunday. The battering came after the digital asset had broken above the resistance at $4,000. The buyers pulled Bitcoin higher above $4,100 but the momentum lost steam short of $4,100 and culminating in declines below $4,000.

The crash was not unique to Bitcoin as the majority of the assets recorded significant declines as well. Ethereum, for example, dipped from the highs marginally below $170 to the levels slightly below $140. Other assets like Ripple (XRP) and Bitcoin Cash broke past key support levels at $0.30 and $130 in that order.

The cryptocurrency market is currently mixed red and green as the buyers battle to recover from the losses seen on Sunday. Bitcoin is trending 1.44% up on Monday after reversing the trend from the low at $3,732.06. It appears to be able between the current core support between $3,700 and $3,800.

The weak upside correction is limited by the initial resistance at $3,800. A break past this hurdle will come face to face with the resistance at the 23.6% Fibonacci retracement level taken between the last high at $4,189.46 and a low of $3,712.089. The 2-hour 50-day Simple Moving Average (SMA) has maintained its position above the longer term 100-day SMA showing that in spite of the declines, the bulls still have the energy to protect key support at $3,700 and even push for gains above $3,800.

Besides, indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence have revamped their direction upwards. You can also expect Bitcoin to remain stable and trade sideways between the core support mentioned.

BTC/USD 2-hour chart