- The bullish move on Thursday saw Bitcoin spike to a 25-day high around $4,057.

- Bitcoin buyers have a task to push BTC/USD back above this hurdle for a continued upside motion.

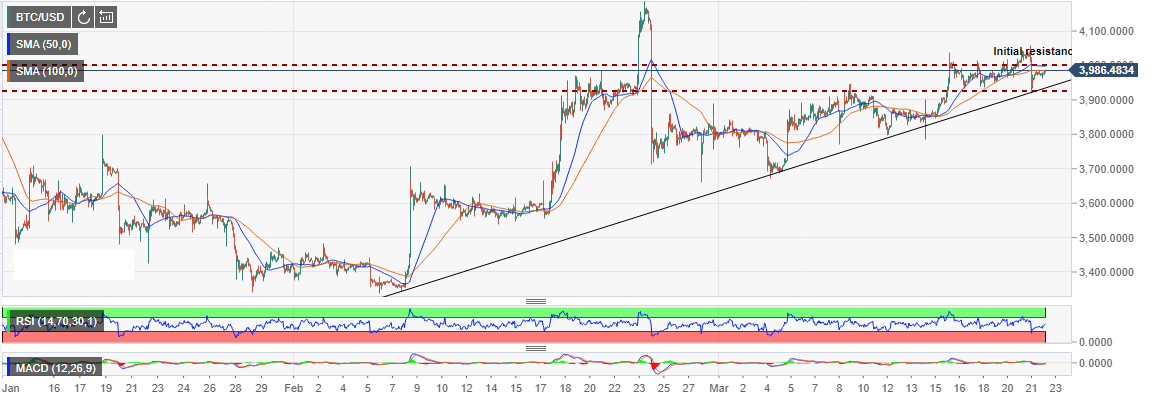

Bitcoin bullish breakout above $4,000 failed to get the most out of the momentum that formed a high at $4,040 yesterday. The largest crypto by market capitalization slumped back below $4,000 but the short-term outlook shows that BTC/USD is still in a bullish trend. However, the buyers are required to keep the price above $3,920.

The bullish move on Thursday saw Bitcoin spike to a 25-day high around $4,057 after it had secured a position above the stubborn resistance at $4,000 on Wednesday. Unfortunately, the bullish pressure was short-lived with the trend culminating in a sharp drop to a 5-day low around $3,920 before reversing the trend to close the week roughly at $3,972.

The downward trend engulfed the trading range that forming on March 16. This move is seen as a negative sign and could also mean that the buyers are getting exhausted. On the contrary, BTC/USD is still on a bullish trajectory with the bounce from $3,920 staying above the trendline that connects it the lows in February.

At the time of writing, Bitcoin is exchanging hands at $3,984 following a 0.28% increase on the day according to the cryptocurrency live rates provided by FXStreet. There is a sign of resistance at $4,000 (50 SMA) according to the hourly chart. Bitcoin buyers have a task to push BTC/USD back above this hurdle for a continued upside motion. Meanwhile, the 5-day low at $3,920 will continue working as support assisted by other levels including $3,900, $3,800 and $3,700.

BTC/USD 1-hour chart