- It seems that Bitcoin price might continue rising as selling pressure fades away.

- The number of whales holding BTC has dropped, but the amount of small holders increased.

One of the most accurate on-chain metrics for sell-offs and increased selling pressure is the number of whales holding a specific coin. It seems that although there are fewer whales holding between 10,000 and 100,000 coins, Bitcoin price has continued to climb, indicating that institutional investors are buying.

Bitcoin price targets $30,000 by the end of 2020

According to statistics extracted from Santiment, the number of addresses that own 1,000 or more BTC own 0.13% more of the BTC supply than smaller addresses did previously since Christmas.

BTC holders chart

Additionally, it seems that whales are sending their coins into exchanges at a lower rate than before, which indicates they are exhausted and can’t sell anymore. The current Exchange Whale Ratio is below 85%. Past price action shows that anything above the 85% range represents a risk of a correction.

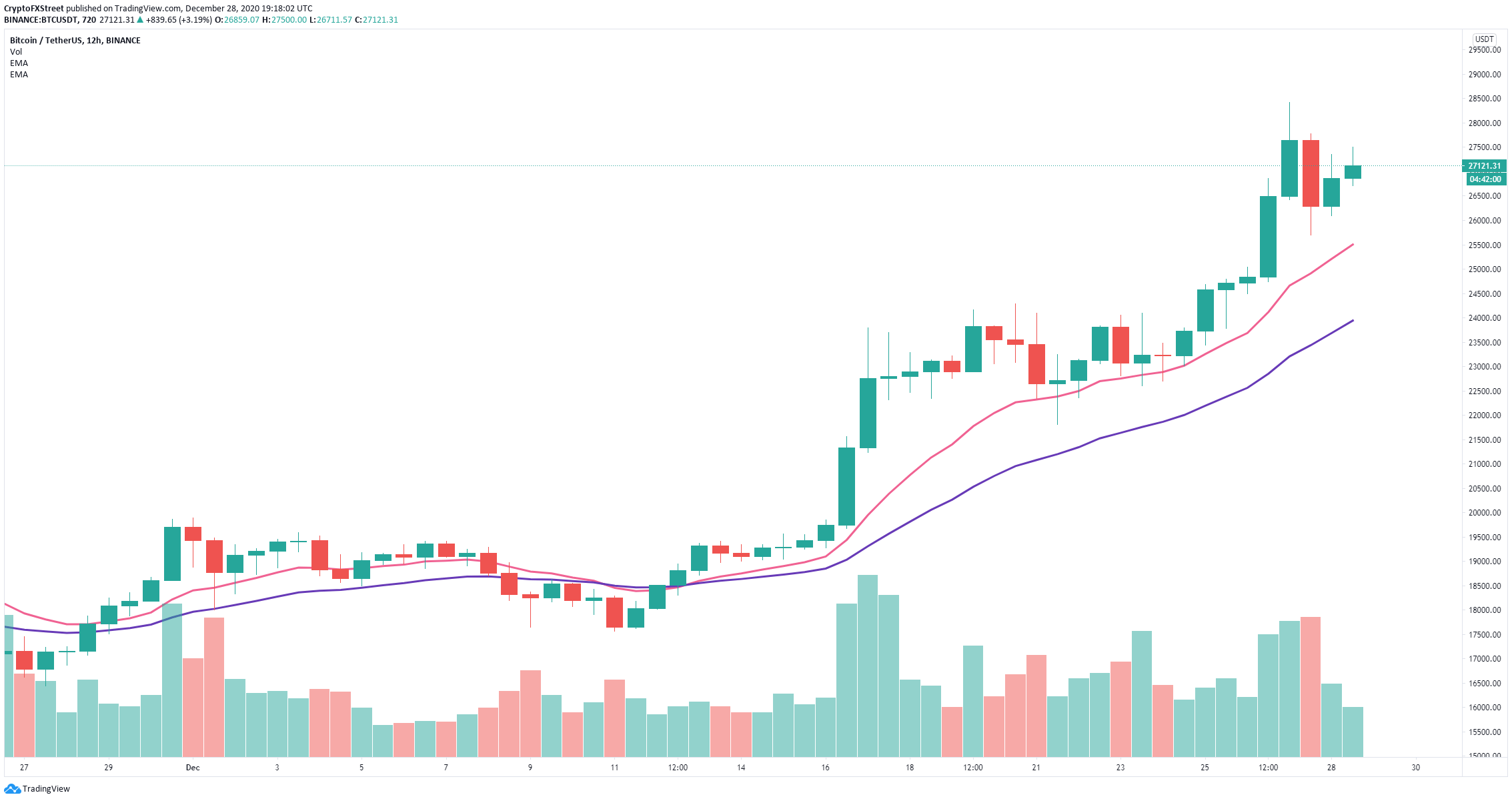

Less than 48 hours ago, Bitcoin price hit a new all-time high at $28,422 and remains trading above $27,000. There are no red flags so far and bulls have been able to keep BTC above the 12-EMA on the 12-hour chart for now.

BTC/USD 12-hour chart

As long as the bulls can hold the 12-EMA and the 26-EMA, the uptrend will remain intact. A breakdown below the 12-EMA at $25,531 can quickly push Bitcoin price towards the 26-EMA at $24,000.

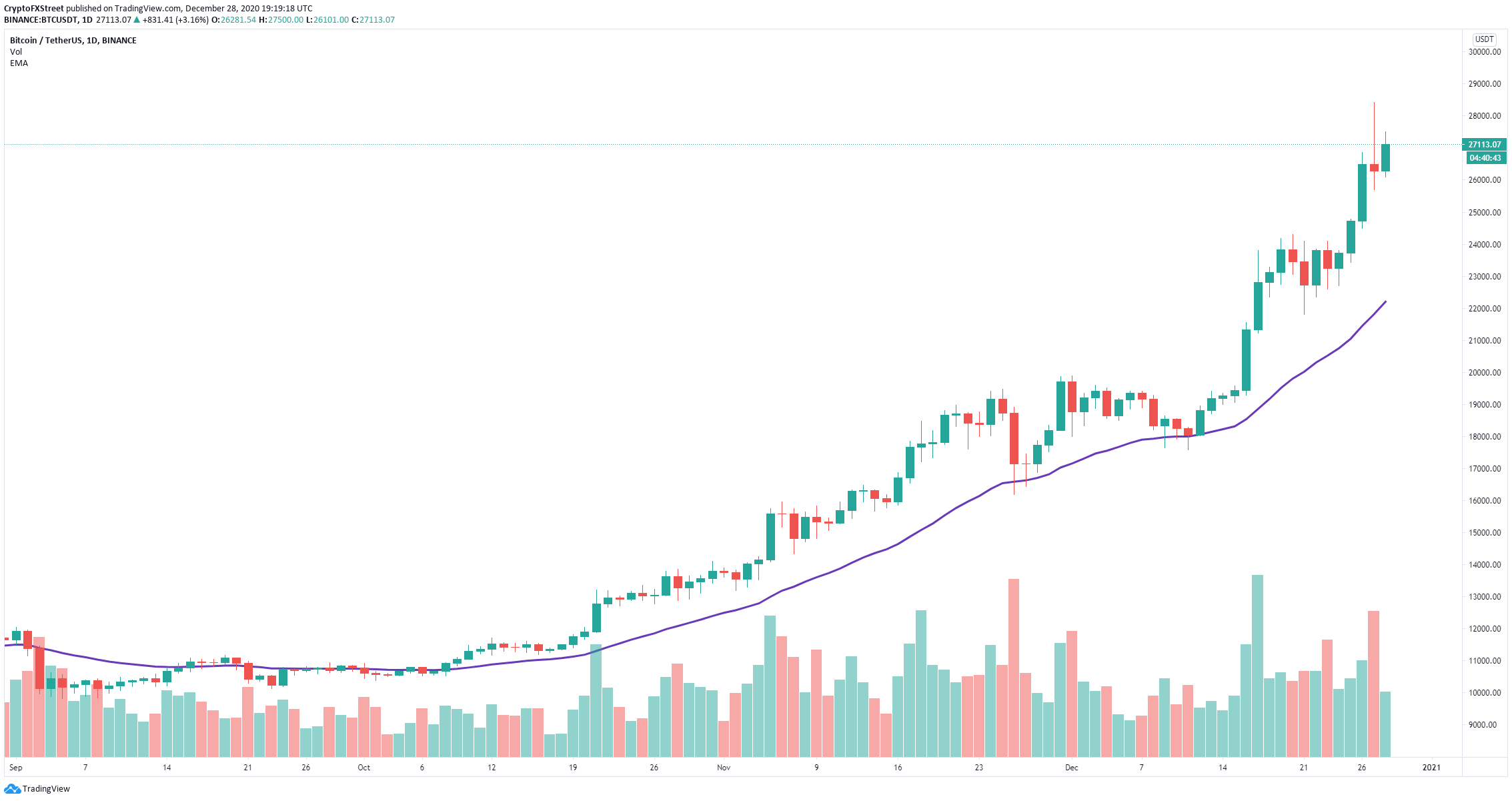

BTC/USD daily chart

However, on the daily chart, the 26-EMA which was defended several times during this rally and served as an accurate dip-buying indicator is established at $22,220 currently. This means that if Bitcoin price drops towards $22,220 but doesn’t crack it, the uptrend will continue.