- BTC stays above key resistance levels.

- The recent momentum proves BTC decoupling from altcoins.

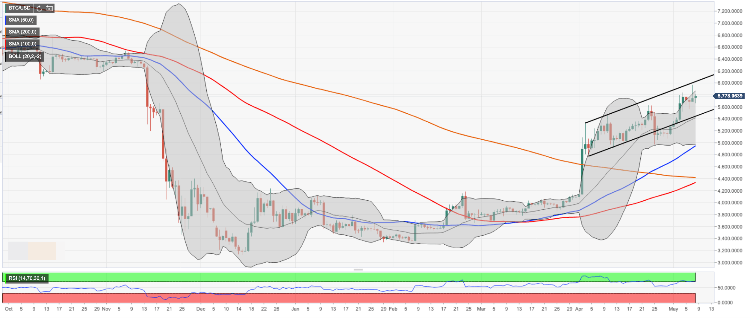

Bitcoin (BTC) retreated from the recent high of $5,969 to trade at $5,750 by the time of writing. While the short-term momentum is dominated by panic and fear caused by Binance hack news, the longer-term outlook remains positive. The technical and the fundamental picture implies that the largest digital coin has bottomed out. Now it is ready for an extended recovery.

According to the recent Bloomberg research, Bitcoin is well positioned to become digital gold, while the fate of other cryptocurrencies also known as altcoins may be less impressive. The decoupling theme is confirmed by the market reaction to the recent Bitfinex-Tether woes and Binance hack: the first digital coin remained relatively stable, while altcoins experienced a strong draw down.

Bloomberg analysts note that Bitcoin’s resilience above the major resistance level may signal the end of the bear market. Thus, the coin moved above $5,500 on May, 3 and managed to stay there for five days in a row.

Record number of shorts is another pre-condition for the beginning of a sustainable bulls market.

“Bitcoin may have reached the inflection point of having just too many bears in the den to support a further downtrend. Record shorts “” the condition at the beginning of May “” should provide underlying support in the short term, leaving the longer-term uncertain and less favorable for the broader market, in our view,” according to the Bloomberg report.

Meanwhile, the key resistance area awaits us on approach to $6,500 with layers of overhang from 2017 bubble.

BTC/USD, 1-day chart