- Bitcoin option’ trading volume reacts to the underlying asset, rising to a new all-time high.

- Technical indicators show that $20,000 remains a significant level of support as Bitcoin price enters uncharted waters.

With the growing euphoria accompanied by Bitcoin’s clear breakout above previous all-time highs, different financial products related to this asset are now witnessing higher trading volume than ever before.

Bitcoin price skyrockets alongside options’ trading volume

Daily traded volume for Bitcoin options has just breached the $1 billion mark for the first time. Statistics from cryptocurrency data analytics platform Skew reveal that the market recorded its highest volatility from November, where it began to close above $500 million.

Deribit exchange led the pack with over 80% of the entire sum at $880 million, followed by bit.com and OKEx. The crypto-derivative exchanges accounted for up to $100 million and $92,000 million, respectively.

It is worth stating that this development coincides with the recent surge in Bitcoin price, which made a significant upswing to $23,700 on Coinbase.

On the weekly chart, Bitcoin currently seems to have begun a new impulse wave following a series of recurring fake outs. After retesting the 34-day exponential moving average twice, it reaffirmed the leap, which was followed shortly after. Printing new candles above this indicator could confirm the beginning of another uptrend phase.

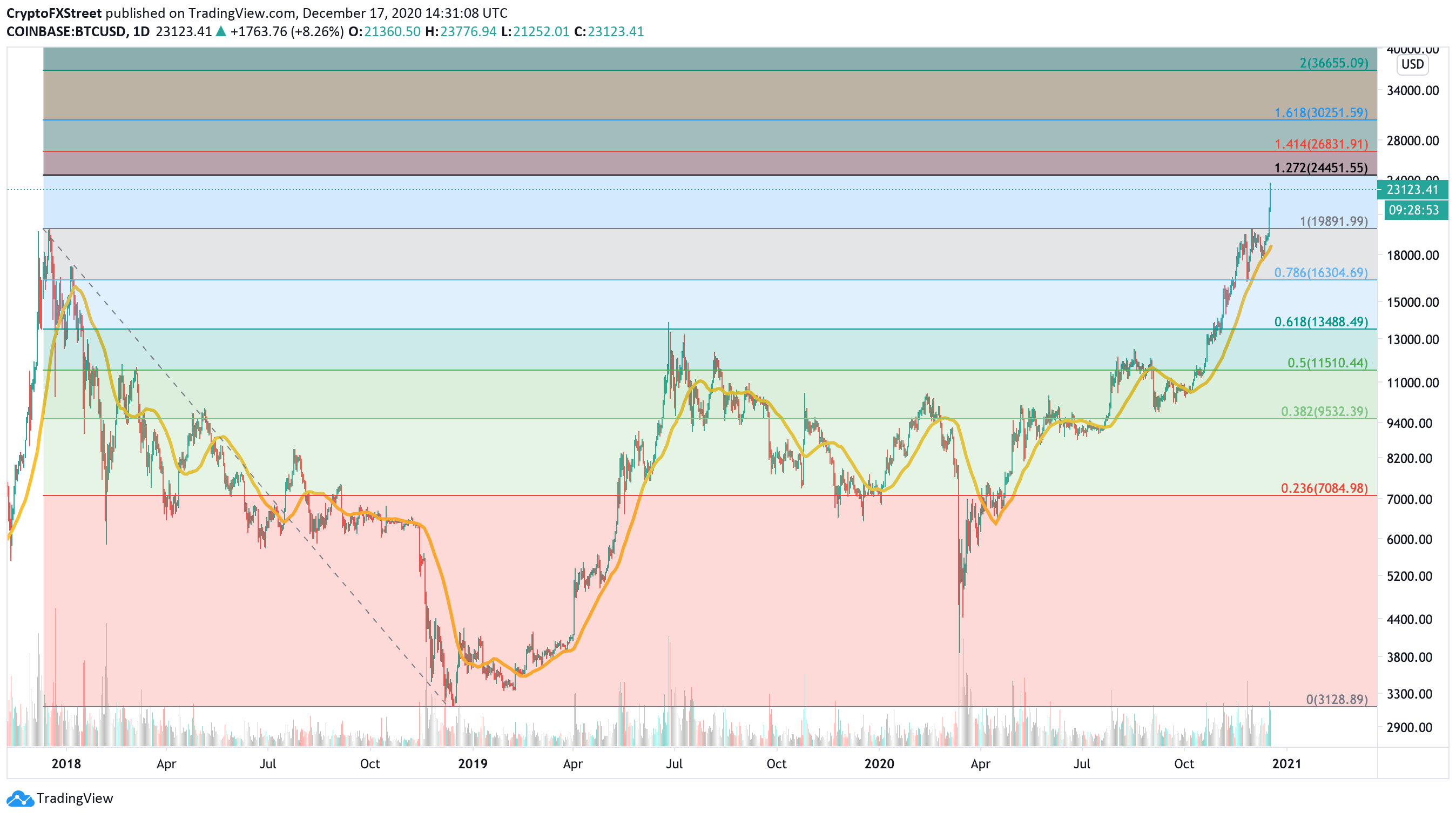

BTC/USD daily chart

With the recent support-resistance flip, the $20,000 zone remains a critical region to watch. Going below this level might send it back to $18,000, where it could quickly regain stronger momentum for another leg up.

Although Bitcoin price sits in new territory at the moment, it may continue to go ballistic in the coming days. The Fibonacci retracement indicator suggests that one of the next focal points sits at $24,450. Moving past this price hurdle may see it the flagship cryptocurrency rise to $30,000, where the 161.8% Fibonacci retracement level sits.

Still, investors may have to wait for a decent consolidation to gauge the next direction of the market in the future.