- Bitwise has listed its cryptocurrency fund on the OTC market.

- Over 465,000 shares were sold during the first trading day.

Bitwise Asset Management listed its crypto index fund Bitwise 10 Crypto on the over-the-counter (OTC) market OTCQX. Over 14 million shares were sold on the first trading day.

A successful start for BITW

The fund has about $120 million in assets under management. It is available under ticker BITW, allowing investors to trade them through traditional brokerage accounts. The listing was approved by the Financial Industry Regulatory Authority (FINRA).

The cryptocurrency data provider Skew reports that over 465,000 shares worth over $14 million were traded during the first day, reflecting an enormous demand for the product from institutional investors. As FXStreet previously reported, Fidelity recently launched crypto-backed loans to satisfy the growing needs of large investors.

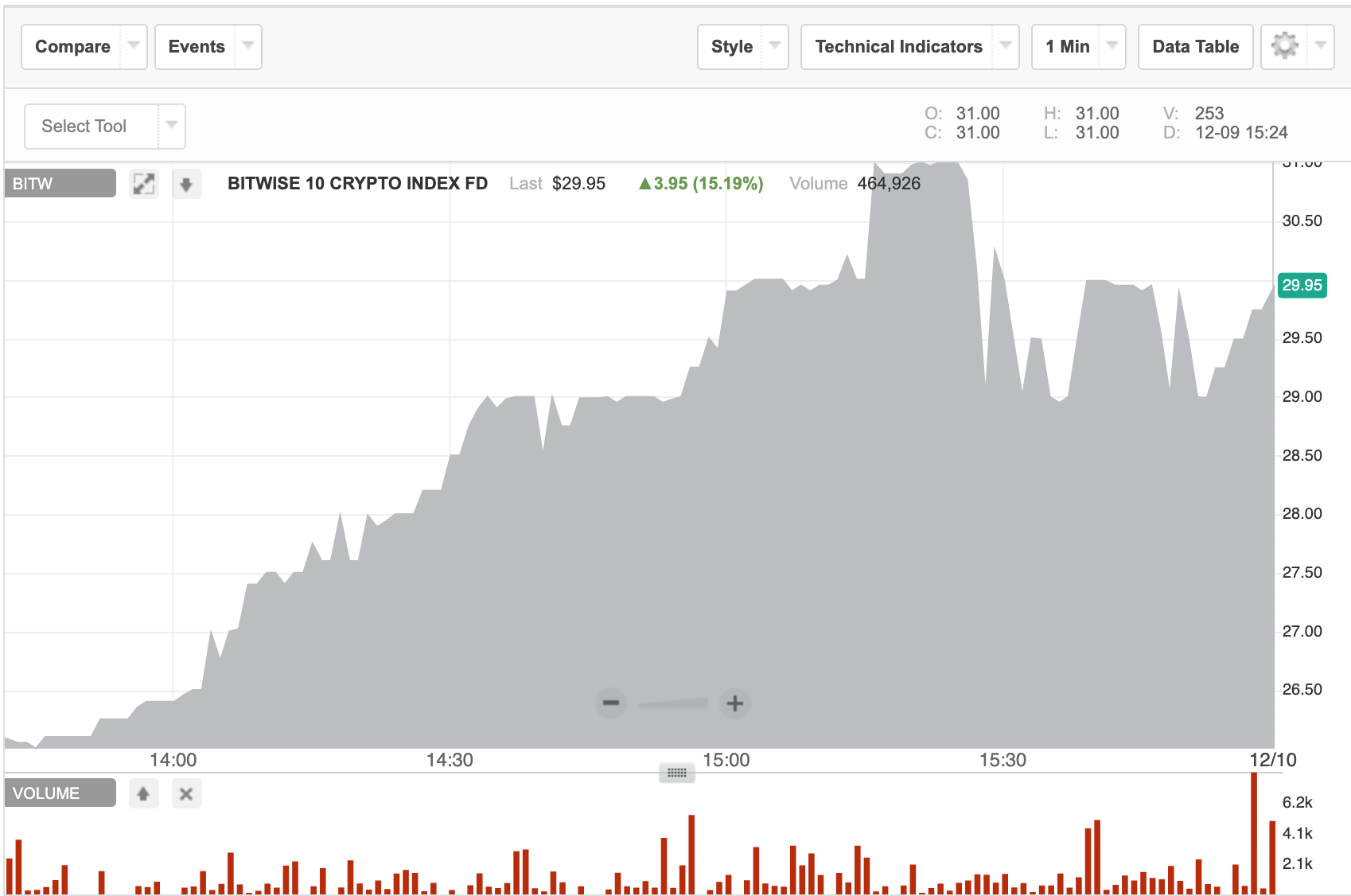

The shares topped at $36.65 and finished the day at $29.95, having gained over 15% during the day. The total market value of the fund is $205,428,787.

BITW chart, source: OTCQX

It is not all about Bitcoin

Bitwise 10 Crypto Index Fund tracks Bitwise 10 Large Cap Crypto Index, a diversified, market-cap-weighted index of the ten largest crypto assets, including Bitcoin (75%) and Ethereum (13). The other 12% is allocated across XRP, Litecoin, Chainlink, Tezos and other assets. The fund is rebalanced on a monthly basis to reflect changes in liquidity and risks. All coins are kept in cold storage with a regulated, insured custodian and audited annually.

Hunter Horsley, co-founder and CEO of Bitwise Asset Management commented in the official press release:

The unprecedented events of 2020 have motivated many to invest in crypto for the first time. With BITW, investors can now get exposure to Bitcoin, Ethereum, and other cryptocurrencies without trying to pick winners or having to constantly monitor the rapid changes in the space.

The company believes that cryptocurrency investment opportunities are not limited to Bitcoin. Moreover, it is only the sixth-best performing asset out of Bitwise 10 year-to-date. On November 30, the fund’s year-to-date profitability was 184%, higher than Bitcoin’s return on investments.

As of the end of October, Bitwise had more than $100 million in assets under management, targeting hedge funds, financial advisers and multifamily offices.

Apart from the Bitwise 10 Crypto Index Fund, the cryptocurrency asset management company offers Ethereum and Bitcoin-based funds. However, their shares are available only via a private offering.