No news is probably good news for the Canadian dollar, at least according to the initial reaction. The Bank of Canada sees a balanced picture, with no changes in forecasts for the local and global economies – business as usual.

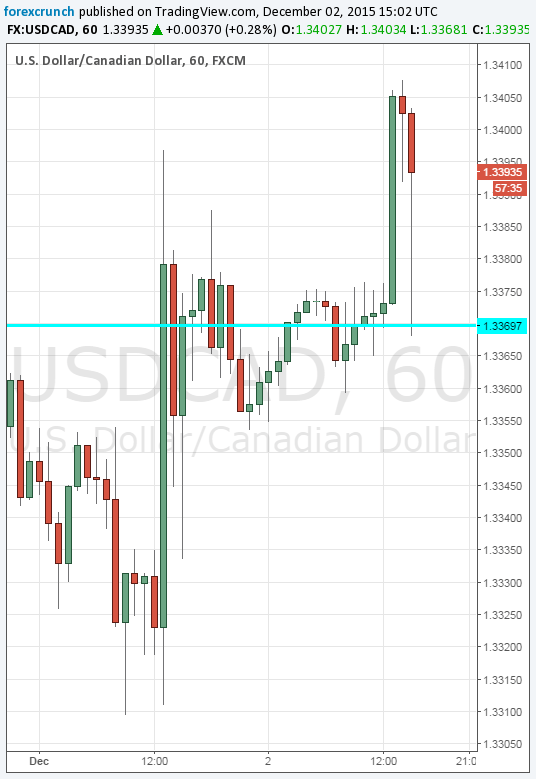

USD/CAD initially dipped to support at 1.3370 but is bouncing back up. Update: it’s falling again. It’s noteworthy that the USD is weakening against CAD despite the greenback showing strength against others.

The Bank of Canada was not expected to change its monetary policy: leaving the interest rate unchanged at 0.50%. The focus is on the statement.

USD/CAD was flirting with 1.34 towards the publication. Resistance awaits at the 11 year high of 1.3460, while support sits at 1.3370.

Earlier this week, Canadian monthly GDP for September came out weaker than expected with a drop of 0.5%. However, other indicators were positive. The recent move higher is fueled by positive US data: ADP NFP beat with 217K and also unit labor costs were revised to the upside.

Recent inflation and employment figures were OK in Canada, but the country experienced a mild recession earlier in the year, and oil prices are going nowhere fast. OPEC is meeting on Friday and Canada releases its jobs report on the very same day.

More: Is USD/CAD Topping Out? Levels & Targets – Westpac