- GBP/USD risk reversals hold at a three-week high on Friday.

- BOE’s dovish hike hasn’t revived interest in the GBP put options (bearish bets).

The Bank of England’s dovish rate hike and the resulting drop in the GBP/USD to 1.3006 has not boosted demand for the GBP puts, risk reversals indicate.

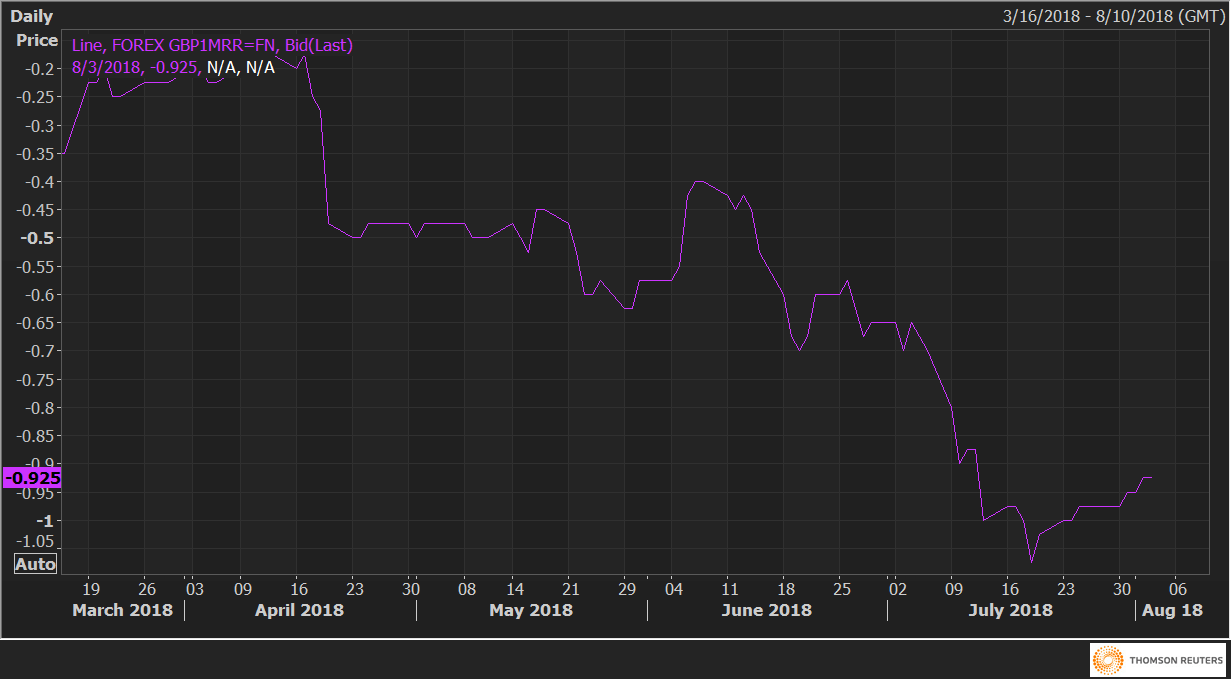

Currently, the GBP/USD one-month 25 delta risk reversals (GBP1MRR) stand at -0.925 – largely unchanged on the day and highest since July 12 – having clocked a low of -1.075 on July 19.

The rise from -1.075 to -0.925 indicates the demand (or implied volatility premium) for the GBP puts had dropped in the run-up to the BOE rate decision.

Further, no change in the risk reversals post-BOE’s dovish hike indicates the investors do not expect a deeper drop in the GBP/USD. This puts a question mark on the sustainability of the drop in the GBP/USD to 1.30.

That said, the demand for the GBP puts may rise sharply, leading to sharp decline in the risk reversals if the GBP/USD pair finds acceptance below the 1.30 mark.

GBP1MRR