- The Grayscale Bitcoin Trust Fund has been buying massive sums of Bitcoin during 2020.

- The most recent report released shows that the fund raised around $1 billion in the third quarter of this year.

Grayscale calls itself the ‘first publicly-quoted Bitcoin investment vehicle’, and it’s dedicated to the investment in Bitcoin in a passive way. The company became an SEC reporting company on January 21, 2020, but debuted on September 25, 2013. It is publicly trading under the symbol GBTC.

Around September 2019, GBTC had around $2.16 billion in assets under management. Currently, Grayscale topped $6 billion in AUM. Although Bitcoin is the prime investment, the company also has around $876 in Ethereum, and lower sums in XRP, LTC, ETC, BCH, XRP, Zcash, and Stellar.

Pompliano, the co-founder of Morgan Creek Digital posted a tweet stating that ‘it’s hard not to be bullish’ because of the massive Grayscale investments.

Grayscale is not the only company interested in Bitcoin

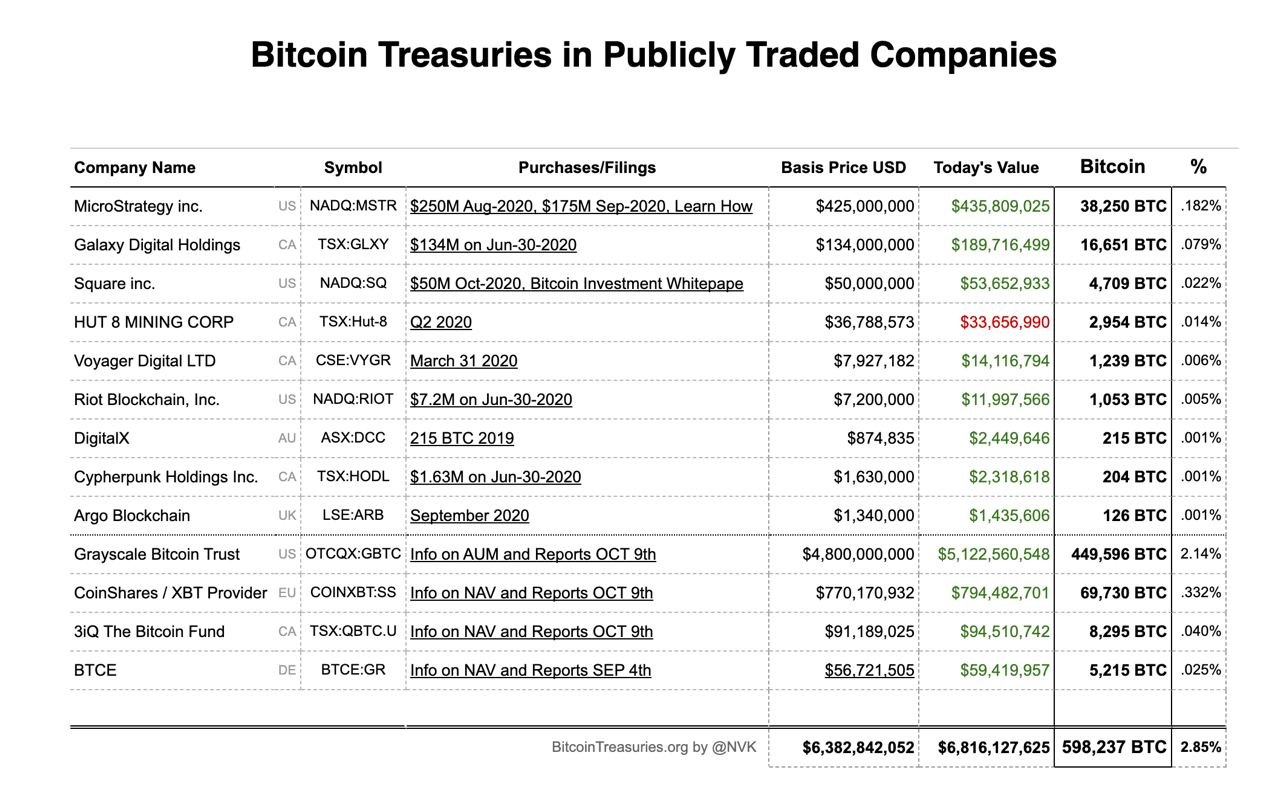

Although Grayscale is by far the biggest Bitcoin Trust Fund currently, there are other funds and companies buying large sums of the digital asset. The second-largest fund is CoinShares, owning around 69,000 BTC. More recently we found out about Stone Ridge and their investment of $115 million in Bitcoin, purchasing around 10,000 BTC.

Bitcoin Treasuries in Publicly Traded Companies

A few days prior to the announcement of Stone Ridge, Square, co-founded by Jack Dorsey, the CEO of Twitter, also announced the purchase of $50 million worth of the digital asset. The total value of all Bitcoin Treasuries in publicly traded companies is close to $7 billion at current prices. 13 companies own around 2.85% of the total supply of Bitcoin