Idea of the Day

Sterling will be the biggest focus on the majors today. This will be the second release of labour market data since the Bank of England set an intermediate target of the unemployment rate at 7% before policy tightening would be considered.

This is a similar approach to the Fed (with caveats) in the US, where a 6.5% rate is cited. Currently the rate in the UK is 7.8%, but a gap has also emerged between when the market believes rates (around 18 months) will start rising and the Bank of England’s central case (3 years).

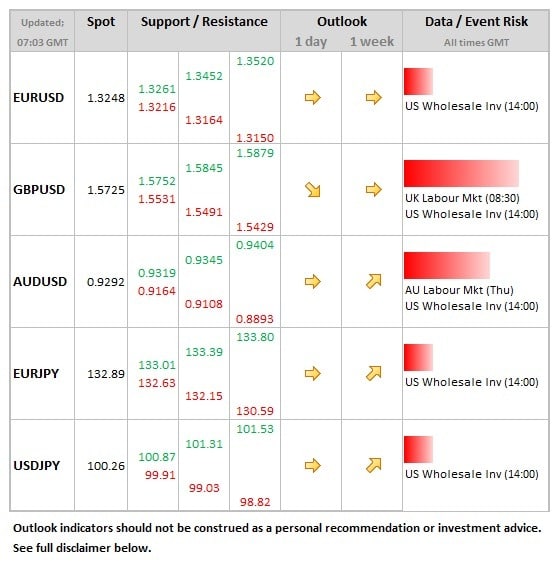

This makes sterling more vulnerable to a weaker labour market report (as market moves towards the Bank view) as compared to a stronger one which potentially sees the rate fall from the current level. On the upside, a break of the 1.5752 level would put cable at 7 month highs. At present, trendline support comes in around 1.5623.

Data/Event Risks

GBP: Labour market data today a key focus, now that the Bank of England has put an unemployment rate of 7% as an intermediate target. A fall would be sterling positive, bringing forward hopes of the first tightening. Sterling more vulnerable to a rise, given that the market expects interest rate increases earlier than the Bank of England’s central scenario.

NZD: The central bank decides on rates early on Thursday. The cash rate is at 2.50% and no change is expected, but the kiwi will be sensitive to any hints of rates rising in the future. The kiwi has performed well, in part thanks to the better tone to the wider dollar bloc (CAD and AUD).

Latest FX News

JPY: The yen weakening in the early part of yesterday’s session, in part helped by the easing of tension surrounding Syria. The softer tone has continued overnight, pushing USDJPY further above the 100 level.

EUR: The single currency dragging behind the more buoyant tone being seen elsewhere, especially from the dollar bloc of the CAD, NZD and AUD. In aggregate, spreads (vs. Germany) on peripheral bonds continue to trade near the lows of the year, which is providing some underlying support.

AUD: There is a growing confidence beneath the Aussie, from both a fundamental and technical perspective, although overnight the Aussie has taken a breather from gains vs. the USD just below the 0.93 area.

Further reading: