The Australian dollar managed to take itself out of the abyss. Calmer markets and good Australian jobs numbers helped.

While some think this is an overshoot here are two bullish thoughts from Citi and UOB:

Here is their view, courtesy of eFXnews:

Citi:

Currency investors should consider buying AUD/USD this week, advises CitiFX in its weekly FX pick to clients.

Citi recommends buying around 0.7117, with a target at 0.73, and a stop loss at 0.7025.

“AUD looks well positioned to benefit from stabilization in sentiment. While drag from regional developments and USD appreciation poses long-term downside risk, with these drivers taking a backseat more positive domestic news-flow could have more of an impact,” Citi says as a rationle behind this call.

“Tomorrow sees the release of the RBA Minutes which are likely to reinforce the hawkish tone of the statement and testimony by RBA Governor Stevens on Friday should undercut any lingering expectation that the RBA will reverse on recent hawkishness in the wake of the softer-than-expected GDP. With investors still discounting some risk for near-term RBA easing, there should be scope for AUD-positive rises in rate expectations,” Citi adds.

“We may look to take this trade off before the Fed decision itself to protect against volatility around the release,” Citi advises.

UOB:

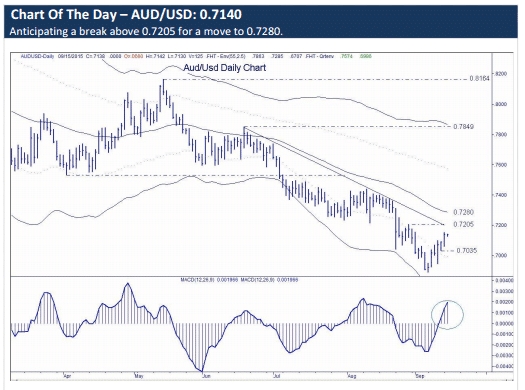

AUD/USD clear break above 0.7120 would indicate that we have seen a shortterm low, says UOB Group.

“While the current up-move is viewed as a corrective recovery, strong upward momentum suggests a break above 0.7205 is imminent. A move above this level could lead to acceleration higher towards the major midterm resistance at 0.7280,” UOB projects.

“In order to maintain the current momentum, any pull-back should not move back below the support at 0.7035,” UOB adds.

Turning to NZD/USD, UOB notes that The pair has been trading choppily for the past couple of days and there is no change to its current neutral outlook.

“Further choppy trading is expected, likely between 0.6244 and 0.6425,” UOB projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.