The Australian dollar and the Canadian dollar both made nice gains on rising commodity prices.

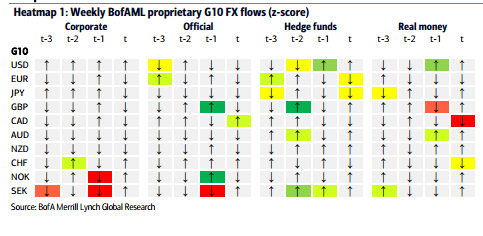

However, they may begin to diverge according to the heatmap by Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

“In the week leading up to the disappointing NFP numbers, our proprietary flows show hedge funds selling EUR and JPY (Heatmap 1).

Although the long USD position against other major G10 currencies is not stretched, pricing-out Fed rate hikes for this year could weigh on the USD in the very short term. The USD could find more support towards the end of the month, ahead of the ECB and BoJ meetings.

The EPFR data show strong risk aversion ahead of the NFP last week, with outflows from both bonds and equities in every single DM and EM. Investors with risk appetite who want to position for a dovish Fed in response to weak US data can buy AUD/CAD. Our flows show both hedge funds and real money buying AUD and selling CAD in recent weeks.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.