Oil prices joined the sell-off in global markets, and this weighed on the C$, which had showed some strength until then. What’s next for the loonie? Here is the view from Credit Agricole:

Here is their view, courtesy of eFXnews:

The lack of significant data releases makes oil the Canadian Dollar’s main player this week, with US oil inventory data (Wednesday) to note given the previous week’s surge.

But the US outlook is increasingly relevant in light of growing concerns over an economic slowdown, which points to less demand for Canadian exports.

Such fears, most recently ignited by the weak ISM non-manufacturing figures and dovish rhetoric from Dudley, have contributed to the broad USD selloff of late, lifting commodity currencies in particular.

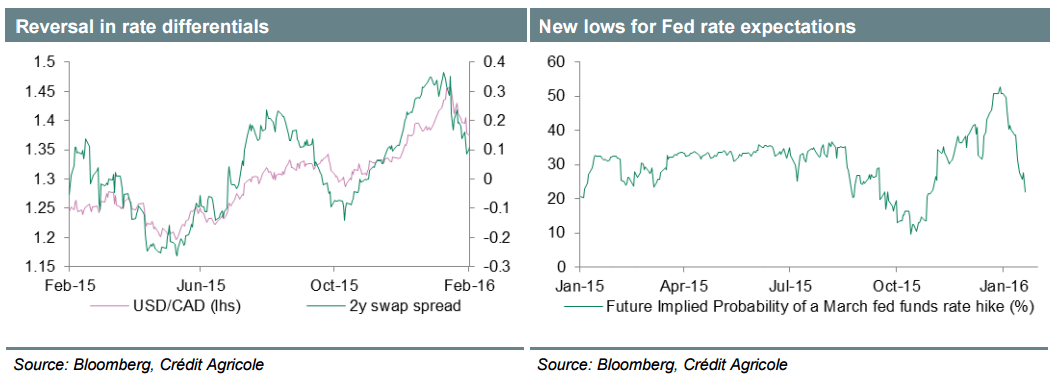

In the near-term, delayed Fed and on-hold BoC limits the scope for widening rate differentials, keeping CAD supported at current levels.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.