- CAD risk reversals drop to the lowest level since July 31.

- The gauge indicates the bearish CAD bias is weakest in over 10 weeks.

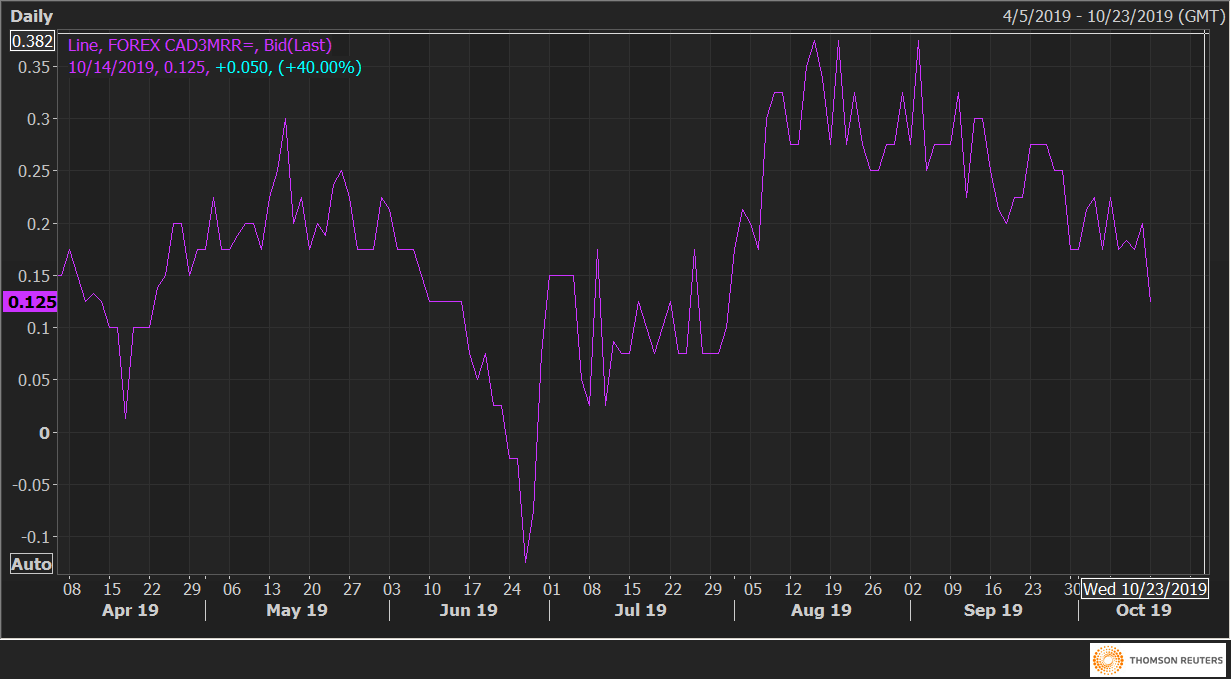

Three-month CAD risk reversals (CAD3MRR), a gauge of calls to puts on the Canadian Dollar, dropped to the lowest level since July 31 on Monday, indicating the CAD bearish bias is weakest in at least 10 weeks.

The gauge is currently seen at 0.125 – a level last seen on July 31 – having topped out above 0.37 in early September.

The pullback represents a drop in demand or implied volatility premium for the CAD put options (bearish bets).

That said, the positive number indicates the premium for puts is still higher than that for calls (bullish bets).

The USD/CAD pair is currently trading largely unchanged on the day at 1.3230, having aborted the immediate bearish set up with an inside bar candlestick pattern on Monday.