- The Canadian Dollar had a terrible week, falling to the lowest in nearly a year on trade and the Fed.

- Friday has a double-feature of Canadian events, but Trump’s trade tirades will dominate the scene.

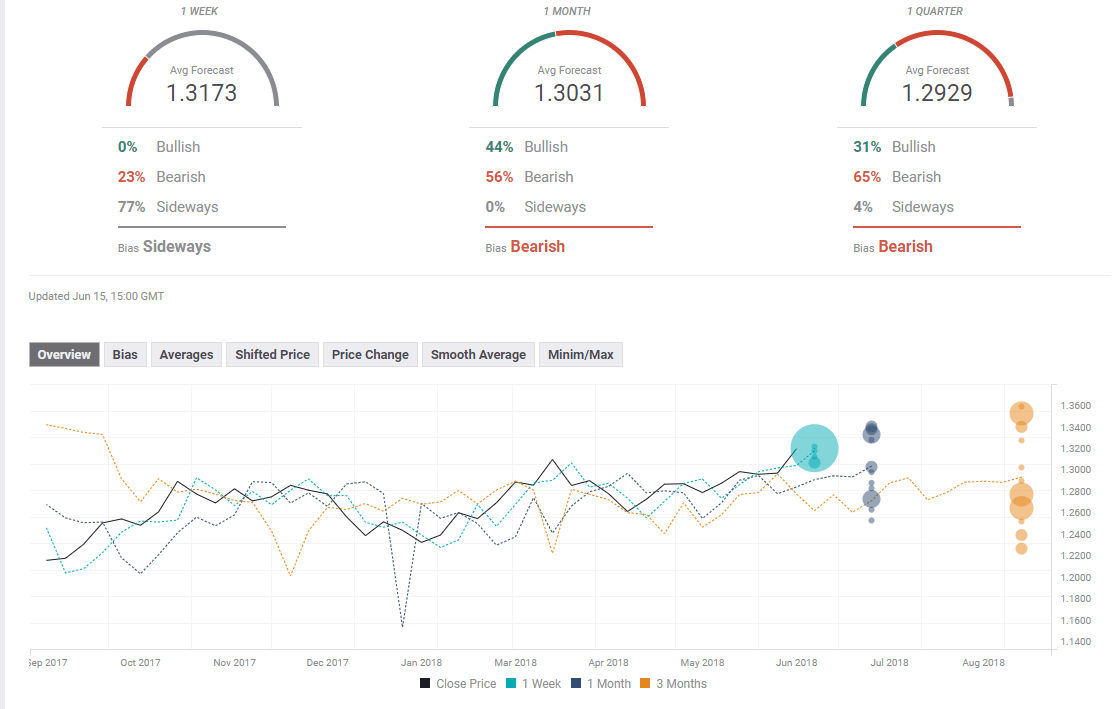

- The technical picture is becoming more bullish, but looking forward, sentiment becomes bearish.

This was the week: Trump-Trudeau clash, Fed’s hawkish hike

The pair opened higher with a Sunday gap as the G-7 Summit ended without a communique. US President Donald Trump clashed with his counterparts and especially with Canadian Prime Minister Justin Trudeau. Trudeau said he would be pushed around and Trump responded with an angry tweet calling Trudeau weak. This is the culmination of stalled NAFTA talks, US tariffs on Canadian steel and aluminum, and other tensions.

As Canada heavily depends on trade with the US, the Canadian Dollar suffered from the clash and continued struggling after the US imposed tariffs on China.

The USD/CAD also advanced on non-trade events. US inflation crept up to 2.2% on the core measure, and US Retail Sales beat expectations and enjoyed upward revisions. Most importantly, the Fed raised rates and also signaled two additional hikes this year. Adding an optimistic tone about the economy and announcing a presser after every decision from January, the US Dollar received a lot of support.

Oil prices remained stable, chopping around in a limited range amid OPEC headlines. Trade is undoubtedly the most significant driver.

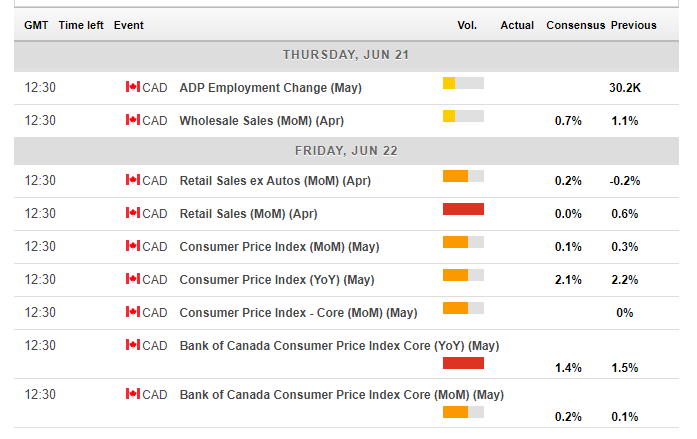

Canadian events: Inflation and Retail Sales Friday, and NAFTA

ADP releases its jobs report for May on Thursday, providing another look at the labor market after the official data disappointed. Wholesale sales will also be of interest.

The big events wait for Friday. The inflation report for May is expected to show a slowdown in Cor CPI from 1.5% to 1.4% and any surprise is likely to overshadow other data points. Headline inflation carries expectations for a slowdown as well: from 2.2% to 2.1%.

The Retail Sales report, published at the same time, are expected to remain flat after +0.6% in March. Sales excluding autos are predicted to bounce and rise by 0.2% after dropping by 0.2% last time. For the data to have a meaningful impact on the Canadian Dollar, both Retail Sales and inflation would need to go in the same direction.

Here is the Canadian calendar for this week.

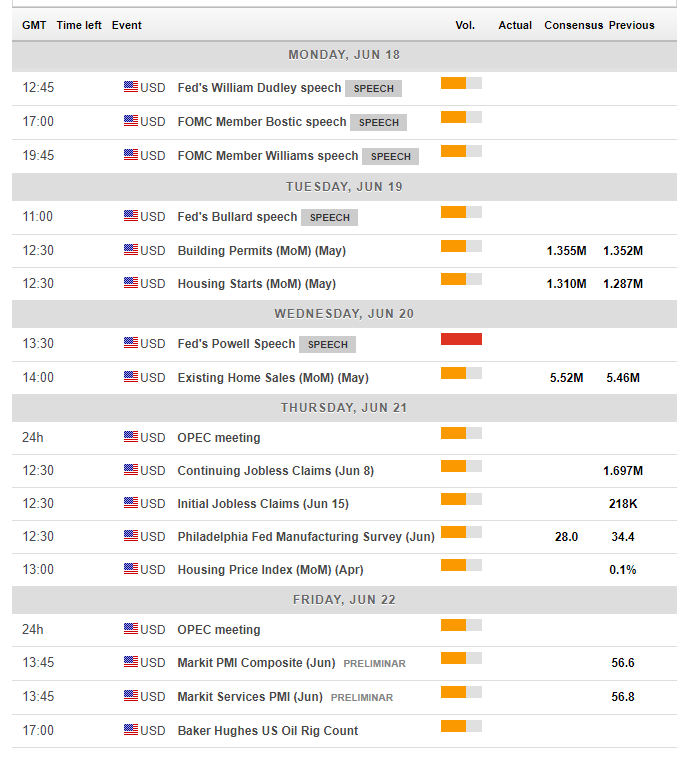

US events: Fed fallout, housing, and more

Markets will continue digesting the tariffs on China, the upbeat US figures, and the hawkish hike by the Fed. The week begins with several FOMC members talking, most notably John Williams of the San Francisco Fed.

Tuesday features housing data where both Building Permits and Housing Starts will need to go in the same direction to see a meaningful reaction. The main event is on Wednesday when Fed Chair Jerome Powell will speak in a conference in Portugal alongside his peers from the euro-zone, Japan, and Australia. Powell may add some comments after the recent data.

Thursday and Friday see only second-tier events, but as mentioned earlier, political news can undoubtedly have an impact.

Here are the critical American events from the forex calendar:

USD/CAD Technical Analysis – Bullish Bias

After the recent surge, the RSI is significantly above 50 and still not at 70, thus not in overbought territory and allowing for more gains. Momentum remains positive. The pair is also considerably above the 50-day Simple Moving Average as well as the 200-day one.

1.3165 was a low point in early June and remains a battleground. The next noteworthy level is 1.3280 which was a temporary cap around that time. The strongest topside level is 1.3380 back in June of last year.

Looking down, 1.3125 was the peak seen in March, and it now switches to support. Further down, 1.3000, the round level, maintains its importance. 1.2930 was a line of support in June.

Where next for USD/CAD?

The week after week deterioration in the relations between Canada and the US does not bode well for the loonie. The pair could continue to higher ground.

The FXStreet Forecast Poll shows that sentiment has improved in the short and medium terms, but remains stable in the long term. With current prices, this implies a sideways move with an average of 1.3173 in the short term, and then a bearish medium-term sentiment with 1.3031 targets and a bearish sentiment with 1.2929 as the target for the longer term.

-636646697757709749.png)