The Canadian dollar suffers pressure due to falling oil prices. Will this continue?

The team at CIBC analyzes and and sets a target for USD/CAD:

Here is their view, courtesy of eFXnews:

Since WTI prices hit $50bbl in early October, they’ve fallen by around 20% to sit around the $40 mark, notes CIBC World Markets.

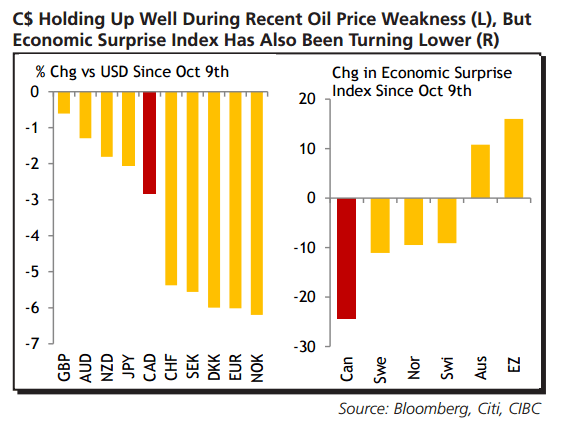

“However, the C$ has been far from an underperformer versus the US$ during that period. Indeed, it has held up very well compared to another oil-driven currency, the Norwegian Krone.

In part that was due to earlier data showing a rebound in growth during Q3 and the erasing of rate cut expectations that went along with that. However, the data flow has turned the other way recently, in line with our expectation that the economy will slow to close to 1% in Q4.

While we don’t expect Governor Poloz to cut again, markets could re-price the probability of such an event, just as the Fed starts raising rates,” CIBC argues.

“That would weigh on the loonie and see USDCAD hit 1.36 in early 2016,” CIBC projects.