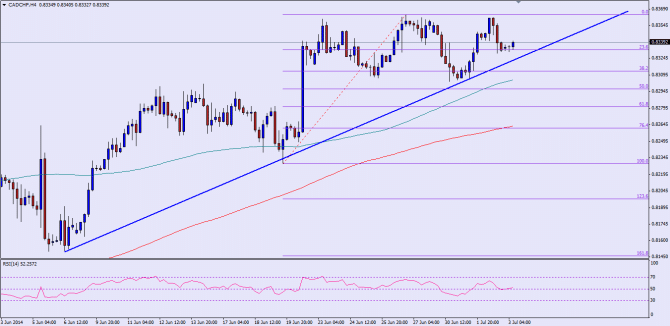

The Canadian dollar has recently gained a lot of bids against most of its counter currencies, including the US dollar. However, it has failed to gain momentum against the Swiss franc. There is a critical bullish trend line forming on the 4 hour chart for the CADCHF pair, which has acted as a support for the pair on a number of occasions.

The pair is again heading towards the mentioned trend line, and it would be interesting to see whether the Canadian dollar buyers can break it this time or not. Currently, the pair is flirting with the 23.6% fib retracement level of the last up-move from the 0.8229 low to 0.8363 high.

If the pair manages to break the trend line, then a move towards the 50% fib level is possible in the short term. The 100 simple moving average on the 4 hour chart also sits around the mentioned fib level. Any sustained momentum might take the pair towards the 76.4% fib level, which is also coinciding with the 200 SMA (4H). The RSI is nudging around the 50 level, and if it breaks lower, then the chance of a move lower in the CADCHF pair would also increase.

On the other hand, if the pair bounces from the trend line and support area, then a move back towards the recent high of 0.8340 is possible in the short term. However, a break above the mentioned level looks difficult as of now considering the current market sentiment.

Canadian Trade Balance Data

Later during the NY session, the Canadian imports, exports and trade balance data will be released by the Statistics Canada. If the outcome comes out positive, then a break of the trend line is possible moving ahead.

Posted By Simon Ji of IKOFX