Draghi didn’t deliver and EUR/USD shots higher (here are 10 points on 400 pips). What’s next?

The team at BNP Paribas has doubts about this rally:

Here is their view, courtesy of eFXnews:

While EUR/USD has squeezed higher following the ECB meeting BNP Paribas doesn’t expect to see an extended recovery from these post-meeting levels.

BNPP notes the following points.

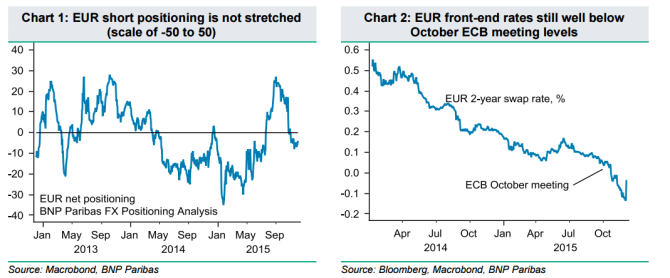

1. EUR short positioning had been building heading into the meeting, but had not reached stretched levels. “Many market participants had favoured limited downside derivative exposure, minimising the potential loss and upside. EUR risk reversals have remained at less-negative levels than might have been expected given the extent of bearish sentiment (and even positive at the very front end), and this has been picked up in our position indicator,” BNPP argues.

2. The ECB has still delivered significant new measures, even if they fell short of elevated expectations. “If we view the 22 October meeting where further easing was first signalled as a starting point, EUR 2-year swap rates are still down nearly 10bp on net (and down 35bp relative to US 2-year yields). Very accommodative policy should still translate into elevated eurozone investor demand for foreign assets as we head into 2016,” BNPP adds.

3. The Fed outlook remains an important driver of all USD pairs. “All things equal, EURUSD trading higher into the FOMC meeting on 15-16 December will make the Fed even more comfortable beginning its rate hike cycle and reduce the risk that the post-meeting press conference dwells extensively on FX risks. Notably, US front-end yields have also risen following the ECB press conference. Over time, rate differentials should continue to trend in the USD’s favour,” BNPP notes.

“We expect EURUSD to stabilise around post-meeting levels before testing back towards 1.06 heading into the FOMC meeting…Our targets of 1.06 for year-end 2015 and 1.04 by the end of Q1 2016 continue to look appropriate,” BNPP projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.