- The Canadian Dollar enjoyed the USMCA but the greenback enjoyed a powerful week.

- A relatively light calendar leaves the focus on oil and echoes from the past week.

- The technical picture is mixed for the USD/CAD.

This was the week: Finally a new NAFTA, but also immense USD strength

Canada and the US reached a framework for a new trade deal. It will be called the United States Mexico Canada Agreement (USMCA). Canada made concessions on its dairy market but retained the arbitration mechanism (Article 19). The news sent the USD/CAD significantly lower in the wake of the new week.

The deal removes a looming cloud above the Canadian economy and opens the door to a rate hike by the Bank of Canada later this month.

On the other side of the border, the US Dollar enjoyed a considerable rally. Markets reacted to the upbeat ADP NFP and the ISM Non-Manufacturing PMI which beat expectations and sent the greenback higher. The US 10-year yield made a major breakout and reached 3.23%, adding support to the US Dollar.

To top it off, Fed Chair Jerome Powell said that monetary could become tight, at least temporarily.

Later, the C$ slipped as oil prices retreated from the highs after inventory data showed a buildup.

Canadian events: Light calendar leaves time to digest

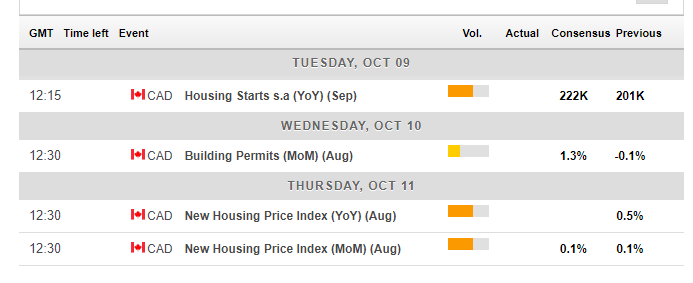

After a busy start to the quarter, the second week of October is focused on second-tier housing figures. Tuesday’s Housing Starts report is projected to show a bounce in the annualized level of starts in September after a disappointing number in August. Building Permits are forecast to increase in August after a drop earlier. Thursday’s New Housing Price Index (NHPI) also carries expectations for an increase.

Oil prices remain central to the loonie, especially as trade headlines are behind us. The US sanctions on Iran lifted crude prices but the picture is somewhat more complicated. Announcements from Russia and Saudi Arabia on petrol production could impact Canada’s critical export.

Here is the Canadian calendar for this week:

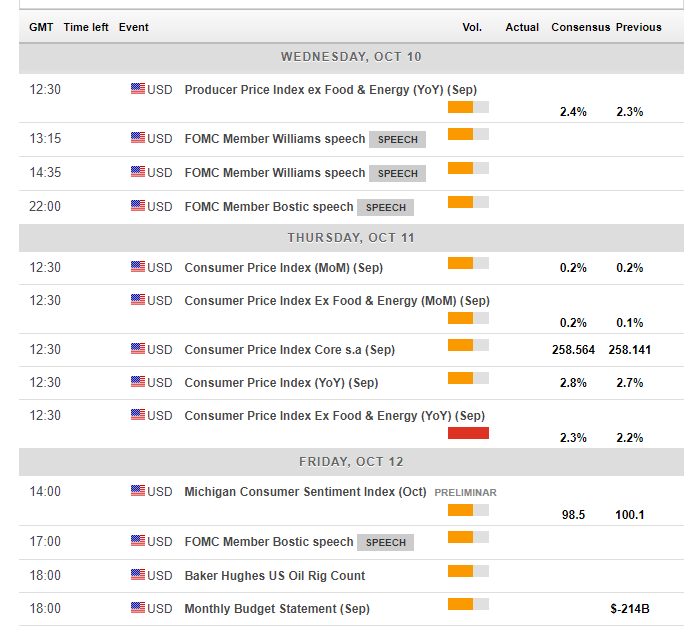

US events: Inflation stands out

The US also enjoys a holiday on Monday, and the economic calendar gets into gear only on Wednesday with speeches by Fed officials and the Producer Price Index which is projected to accelerate on the core figure.

The primary event of the week is due on Thursday. The Core Consumer Price Index disappointed in August with a retreat to 2.2% from 2.4%, ending months of gradual increases. This time, a small acceleration is on the cards. The Fed sees inflation remaining around the 2% target, without any significant upside or downside risks. The fresh figures for September will provide more insights.

The last word of the week belongs to the preliminary Consumer Sentiment by the University of Michigan. The survey lags behind the CB Consumer Confidence which hit 18-year highs in September.

Here are the critical American events from the forex calendar:

USD/CAD Technical Analysis

The USD/CAD remains in the broad channel that accompanied it since June but was broken twice to the upside. It trades between the 50-day Simple Moving Average and the 200 one. The Relative Strength Index is balanced around 50 and Momentum leans lower.

1.2970 was a double-bottom after supporting the pair in August and in September. 1.3075 capped the USD/CAD in mid-September and cushioned it in July. Close by, the round number of 1.3100 held the pair down in August. 1.3175 was another stubborn cap back in August and 1.3225 was the high point in September.

1.2880 was a double-bottom after providing support in late August and late September. 1.2820 is a veteran support line dating back to May. It is closely followed by the October low of 1.2775. Further down, 1.2730 provided support in May.

USD/CAD Sentiment

The new NAFTA deal, or USMCA, is not fully priced into the Canadian Dollar. The loonie could resume its rise even if the greenback gains ground against other currencies.

The FXStreet forex poll of experts provides intriguing insights.

-636743268149663403.png)