- The Canadian Dollar had a wild week with optimism by the BOC crushed by Trump’s tariffs

- Canada’s jobs report stands out and has all the attention to itself.

- The technical picture remains indecisive after the recent swings.

BOC suddenly hawkish, but the economy and tariffs weigh

BOC: The Bank of Canada left the interest rate unchanged as broadly expected but made significant changes to its statement. They removed the need for caution when discussing rate hikes and also dropped the wording about accommodative monetary policy. This sent the C$ higher. Stephen Poloz and his colleagues were also upbeat on wages and said that Q1 growth was slightly better than forecast.

But then came the quarterly GDP report and it missed expectationswith 1.3% annualized, reversing the moves and weighing on the loonie in what looks like an embarrassment to the central bank.

President Trump drew attention away from the Non-Farm Payrolls report. He tweeted about looking forward to seeing the numbers and sent the US Dollar rising prematurely. The reaction to the actual release was muted, even though the numbers looked good. The economy gained 223,000 jobs and wages rose by 0.3% MoM, above expected. America’s jobless rate fell to 3.8%.

The loonie had no time to digest the data nor recover as the Trump Administration announced the implementation of steel and aluminum tariffs against Canada, Mexico, and the European Union. Canada’s reaction was swift, proclaiming retaliatory tariffs on US goods and denouncing the American move. The Canadian economy is heavily dependent on the US.

The trade war risks NAFTA negotiations which are stuck. Canadian Prime Minister Justin Trudeau revealed that the three parties were close to clinching a deal before Trump reintroduced his demand for a sunset clause. With a populist President set to win the elections on July 1st, the chances for an agreement are diminishing.

Canadian events: Housing and the jobs report

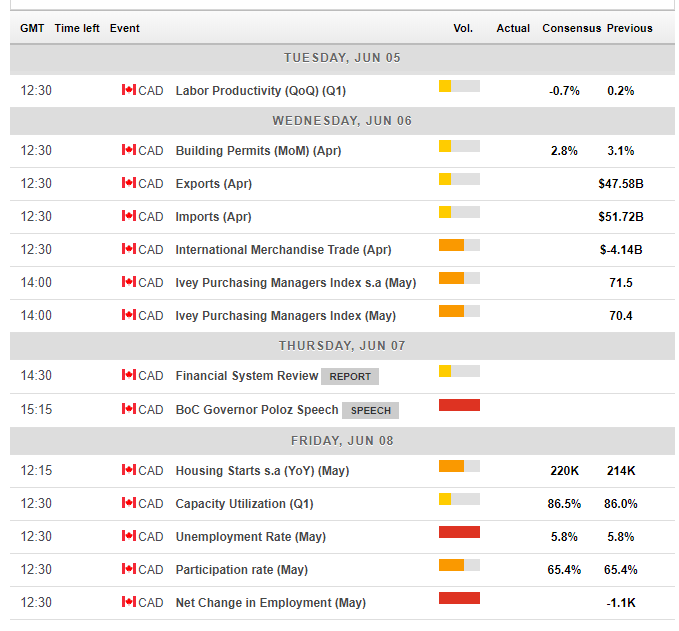

Labor productivity kicks off the week on Tuesday, but more interesting indicators await for Wednesday. Canada’s trade balance is expected to show a deficit in April, as in the previous month. Building Permits will be eyed as elevated housing prices remain an issue in Canada. The Richard Ivey Business School’s purchasing managers’ index reached a sky-high level of 70.4 points in April and may slip in May. On Friday, Housing Starts are published just before the jobs report.

Canada’s labor market report is the star of the week. It gets the full stage to itself after the US has already published the Non-Farm Payrolls and as no significant US indicator is lined up. Canada lost 1,100 positions in April, in a disappointing outcome and a considerable bounce back is likely in May. The unemployment rate remained unchanged at 5.8% for the third consecutive month. Any change to the unemployment rate should be examined through the lenses of the participation rate which stood at 65.4% in April. The composition of the jobs is also of importance: markets would cheer full-time employment and dismiss part-time.

Here is the Canadian calendar for this week.

US events: ISM Non-Manufacturing PMI and trade shenanigans

Factory Orders kick off the week on Monday and may see some moderation after a big jump of 1.6% in March. The main event is on Tuesday with the ISM Non-Manufacturing PMI. The services sector is America’s largest. While the publication comes after the Non-Farm Payrolls, its forward-looking nature is set to be the most significant US economic indicator of the week.

The US trade balance is published on Wednesday, at the same time as Canada’s figure and is set to show a significant deficit. Unit Labor Costs are eyed as well, as they reflect developments in salaries. Rising labor costs imply higher inflation in the pipeline.

With no outstanding top-tier economic indicators, any news trade will likely have a major impact. The retaliatory tariffs by Canada may trigger new measures by the US, which in turn, could result in further moves by Canada. This scenario is an adverse one and has a lower probability.

However, the current moves are enough to cast a dark cloud over NAFTA negotiations. A conciliatory tone by Canadian and American negotiators may boost the loonie, while a further aggravation could send it lower. Canada has more to lose in a trade war.

Here are the critical American events from the forex calendar:

USD/CAD Technical Analysis

The pair enjoys an upside trend despite the recent choppy activity. The broad and moderate uptrend remains intact and the pair held above the 50-day Simple Moving Average. The RSI is slightly above 50, and the pair still enjoys upside momentum. These technical signals accumulate a bullish bias.

1.3000 is not only a round number, but it also held the pair back on May 8th and earlier in the year. 1.3050 was the high point on May 29th and also served as support when the pair traded on the higher ground earlier this year. 1.3125 is the 2018 peak.

1.2950 capped the pair in March and April and remains a pivotal line. 1.2905 worked as resistance in late April. 1.2860 capped the pair on its way up in April. 1.2820 was a low point on May 31st and also where the 50-day SMA meets the chart. Further down, 1.2800 is a round number which is followed by swing lows at 1.2750 and 1.2730, both s

Where next for USD/CAD?

The Canadian Dollar continues having more reasons to fall than to rise. The worsening relations with the US that Canada is dependent on are likely to continue hurting the loonie even if Canada’s jobs report beats expectations. All in all, a continued advance is on the cards.

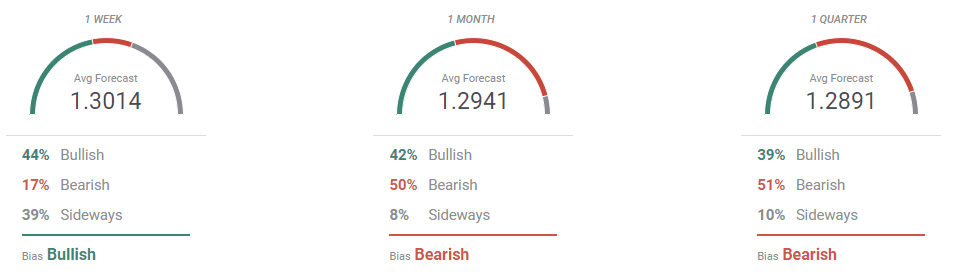

The FXStreet Forecast Poll shows a bullish bias in the short term, in line with the views expressed here.

More: For USD/CAD, 1.3000 is more than a round number”” Confluence Detector

-636634453858077816.png)