- The Canadian Dollar moved choppily on NAFTA headlines and lost some ground within the range.

- The Bank of Canada’s decision and quarterly GDP stand out.

- The technical picture is mixed after the recent range trading.

NAFTA headlines, looser Fed, and risk off

At one point, Trump tweeted a hint about US automakers that was perceived as optimism about reaching a NAFTA deal. Canadian negotiators expressed hope, but that is not news. However, talk of a “skinny NAFTA” deal was disappointing. It seems a deal is not getting closer and this weighs on confidence in the Canadian Dollar.

The FOMC Meeting Minutes confirmed that the Fed is set on raising rates in June but might take a break afterward. The minutes clarified that Powell and co. may tolerate higher inflation, thus pausing the June rate hike. The publication slightly hurt the greenback.

On the other hand, the US Dollar gained from fear, losing only to the yen. The worsening of trade relations with China (after a promising start to the week) and the cancellation of the Trump-Kim Summittriggered a risk-off sentiment that hurt stocks and risk assets like the Canadian Dollar.

Canada published only a third-tier figure, Wholesale Sales, which slightly beat expectations and did little to move the C$. The upcoming week is different.

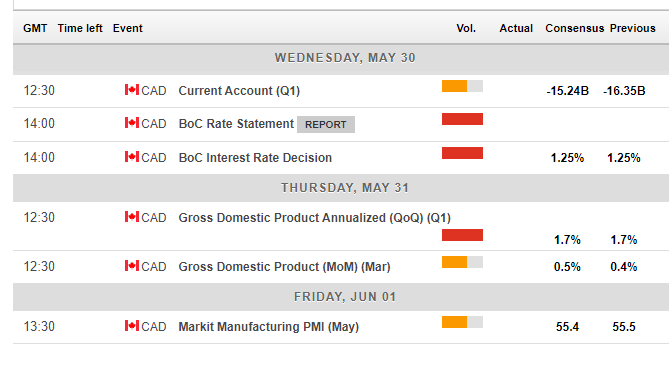

Canadian events: BOC and GDP in one day

The week begins with an update on Canadian Current Account Deficit for Q1. The deficit shrank to 16.35 billion in the last quarter of 2017.

The Bank of Canada left its interest rate unchanged in the April decision. While they maintained expectations to raise rates in the future, the tone was cautious. Since then, several figures came out below expectations. The BOC is therefore expected to leave the Overnight Rate unchanged at 1.25% and refrain from hinting that a hike is happening in the July meeting. The statement will likely contain text about the uncertainty regarding trade relations. Canada is very dependent on the US, and the neverending nature of NAFTA talks already has consequences.

The nation is unique in publishing growth data on a monthly basis. This time, Canada releases data for March, concluding the first quarter and putting the focus on quarterly growth. After the economy grew by a modest 1.7% annualized in Q1, an even slower growth rate is expected, at least by the Bank of Canada. A pickup is due for Q2. The reaction might be choppy as traders will still be digesting the BOC decision on the previous day.

A speech by the BOC’s Sylvain Leduc on Thursday may add some clarifications to the BOC decision and Markit’s Manufacturing PMI on Friday will likely show ongoing OK growth in this small yet essential sector.

Here is the Canadian calendar for this week.

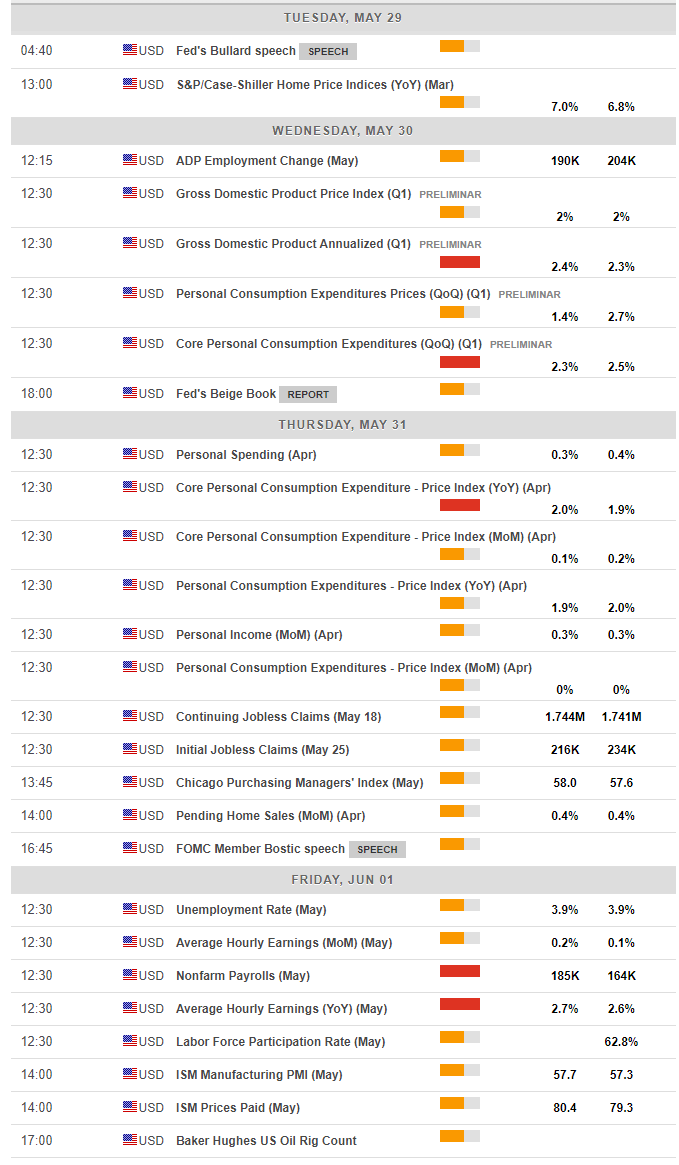

US events: Quick NFP, GDP update, and more

After the Memorial Day holiday on Monday, the S&P Case Shiller release on Tuesday is the first notable event. Wednesday sees a busy US morning with the ADP Non-Farm Payrolls serving as a hint to the official announcement on Friday. 15 minutes later, the US publishes the second estimate of GDP growth for Q1, which may show a small upgrade. Stronger growth in personal consumption would be preferred over inventory growth.

On Thursday, the last day of May, we will probably see some end-of-month flows. Also, the Fed’s favorite inflation measure, the Core PCE Price Index, may finally reach 2% and cheer the US Dollar. Also, watch out for the Personal Spending, Personal Income, and the Chicago PMI which will add to the choppy trading.

And Friday sees the all-important Non-Farm Payrolls. After a disappointing job growth of 164,000 in April, a stronger rate is on the cards for May, back to the averages around 200,000. Wages, which tend to carry slightly more weight in the past year, have slowed down to 2.6% YoY in April. An acceleration back to 2.7% YoY and a monthly rise of 0.2% is forecast. Average earnings need to rise to see sustained core inflation and an accelerated pace of rate rises.

The ISM Manufacturing PMI and its essential Price Paid component will not serve as a hint to the NFP but will have the last word of the week and could move markets, especially if the NFP comes out within expectations.

Here are the critical American events from the forex calendar:

USD/CAD Technical Analysis – Getting closer to downtrend resistance

The USD/CAD broke above the short-term wedge (thin black lines on the chart) without any fanfare. More importantly, it is approaching the more significant downtrend resistance level that is already below 1.3000.

The RSI is above 50 and below overbought territory of 70, pointing to gains. However, the pair has no Momentum.

On the topside, 1.2930 capped the pair on May 15th and remains essential. Further up, the downtrend resistance level awaits at 1.2950. The round number of 1.3000 looms above as it was also resistance in early May and in early March. The 1.3050 and 1.3030 levels are next up.

1.2860 capped the pair in late April. Below, the round number of 1.2800 served as support in early May. 1.2730 was the low point in May.

Where next for USD/CAD?

President Trump is growing more hostile to trade, hurting Europe with the Iran sanctions and changing his mind against China. While the US President remains unpredictable, the tough approach to multilateral deals will likely result in no positive headlines, at least not this week, on NAFTA. The worsening market’s sentiment on other fronts is not helpful either. Adding a cautious BOC after the recent weak data, only an upbeat Canadian GDP could help the loonie. All in all, the Canadian Dollar has more reasons to fall, and the USD/CAD could move up.

The FXStreet Forecast Poll shows interesting insights.

-636628383909533322.png)