- Economists expect Canada to report a loss of jobs after seven months of gains.

- Low expectations raise the chances for an upside surprise and a C$ advance.

- The US Nonfarm Payrolls are released at the same time and may trigger high USD/CAD volatility.

When the bar is low, it is easier to surpass it – and in the case of Canada’s jobs report, estimates are negative. The first jobs report released in 2021 refers to the last month of 2020 and may mark a downturn.

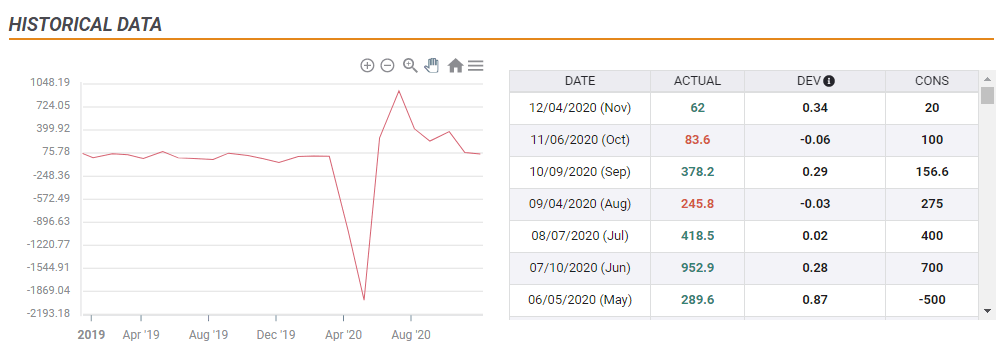

After shedding roughly three million jobs in the initial surge of coronavirus in the spring, Canada gained new positions for seven straight months. The new winter wave and the slowdown in the US – which is responsible for substantial demand for Canadian goods – may have caused a net loss of around 5,000f positions.

Source: FXStreet

However, there are reasons to expect a positive surprise. First, hiring in Canada beat estimates in eight out of 11 months in 2020. There is a significant chance that the twelfth and final read will be similar to the majority – an upside surprise.

Moreover, Canada’s government has been pumping funds into the economy to keep it running – contrary to the US, where bipartisan fighting delayed the most recent stimulus.

USD/CAD response

The Canadian dollar has room to rise if the upside surprise is meaningful – another month of job gains. Any positive number is loonie-positive.

For the C$ to suffer, the loss of positions would need to be considerable, closer to 50,000. Moreover, it would likely need to be accompanied by a leap in the Unemployment Rate. The economic calendar is pointing to an increase from 8.5% to 8.6% and a figure closer to 9% would deal a blow to the Canadian dollar.

The US Nonfarm Payrolls are published at the same time and may have significant sway on USD/CAD than Canada’s jobs report. America has probably gained jobs, yet far below the pace in previous months.

If the world’s largest economy suffered job losses, it could weigh on the greenback in expectations for further stimulus from the Federal Reserve later in the month. The Fed prefers being on the fence but may be forced to act. An increase in US hiring would probably allow Canada’s figures to move USD/CAD.

Conclusion

Canada is expected to have lost jobs in December, but there are reasons for an upside surprise. Any positive figure could boost the loonie, but the move against the US dollar depends on the simultaneous publication of US employment statistics.

More USD/CAD Price Forecast 2021: The complications of COVID-19 on the loonie and the hope for a recovery