- Canada is projected to report a jump of 275,000 jobs in August, slower than in July.

- The unemployment rate is set to slide to 10.1% and a surprise could be beneficial for the C$.

- America’s simultaneous publication of Non-Farm Payrolls may trigger choppy trading.

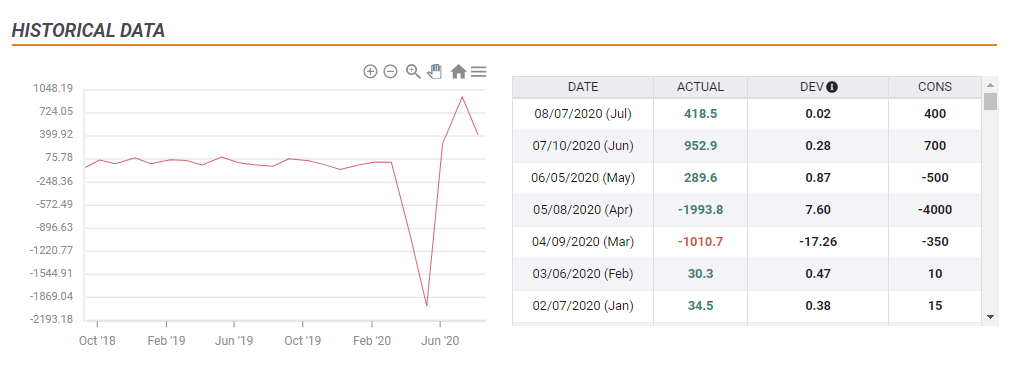

The worst is probably over, but when will things get back to normal? Canada has restored around 1.66 million jobs in the past three months – 55% of around three million lost positions in March and April. After four months of beating economists’ estimates, has the northern nation continue hiring at an accelerated pace?

The economic calendar is pointing to an increase of 275,000 positions in August, slower than 418,500 reported in July. Nevertheless, that is still a substantial change in comparison to the pre-coronavirus era:

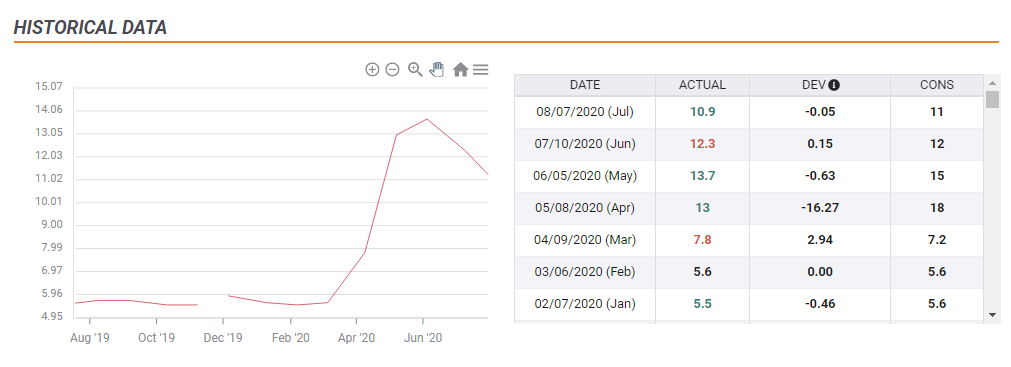

The expected increase in employment is set to push the jobless rate down from 10.9% to 10.1% – but that heavily depends on the participation rate, which has been more volatile in recent months. The recovering labor market is set to draw discouraged workers back in, pushing participation up from 64.3% to 64.6%.

There are good reasons to believe Canada is on a recovery path. The global economy is licking its wounds from the downfall and COVID-19 seems under control in Canada.

Contrary to its southern neighbor, which experienced a second wave of the disease, Canada kept the illness in check:

Source: FT

How will the loonie react?

Three factors determining the USD/CAD reaction

The main driver of the Canadain dollar in response to the data is the headline figure. A beat with over 300,000 jobs gained would push the C$ higher while a sub’250,000 increase would be determintal to the currency.

As the changes in positions have been extraordinary in recent months – and prove hard to estimate – there is room for the unemployment rate to steal the show. A decrease of joblessness beneath the psychologically significant 10% would likely boost the loonie – perhaps overshadowing the change in jobs.

A single-digit unemployment rate would be encouraging for Canada. An unlikely increase to 11% or higher would already weigh on the C$.

The third factor is the US Non-Farm Payrolls – published at the same time – that will likely have a tremendous effect on USD/CAD. America is set to report another month of over one million jobs and its jobless rate is set to dip below 10%. Another surprisingly strong NFP would support the greenback while a slowdown in hiring would weigh on it.

Apart from the data – from both sides of the 49th parallel north – the market mood remains broadly against the US dollar. Despite a correction, the greenback continues suffering from the Federal Reserve’s dovish shift. That may tilt Dollar/CAD lower in case the figures do not provide significant surprises.

Conclusion

Canada’s labor market is set to post another month of recovery, albeit at a slower pace. Apart from the increase in jobs, a drop in the unemployment rate below 10% could steal the show. US Non-Farm Payrolls may trigger choppy USD/CAD trading.

See Non-Farm Payrolls August Preview: US dollar is waiting for good news