- Bondy Finance will roll out DeFi support on Cardano’s blockchain ahead of the Goguen update.

- ADA ready for a breakthrough from a symmetrical triangle, on the verge of a 30% move.

Cardano (ADA) occupies the 8th position in the global cryptocurrency market rating. The coin is changing hands at $0.15 after the downside correction from the multi-month high at $0.19 hit on November 24. The coin has gained over 3% in the past 24 hours and lost 2.9% on a week-to-week basis.

Cardano’s current market capitalization is registered at $4.7 billion, while its average daily trading volumes settled at $750 million.

Cardano joins the DeFi race

The Cardano blockchain’s team is rolling out new features under a major protocol update know as Goguen. At the end of October, the developers announced that the network would move to Goguen by the end of February 2021.

Meanwhile, the recently announced partnership with Bondy Finance will allow Cardano to introduce decentralized finance (DeFi) to its blockchain. Bondy Finance is the project behind the Polkadot platform. It will integrate the support for BONDLY coin into the Cardano network before the fully functional version of Goguen goes live in February.

Further steps will include integrating Bondly’s over-the-counter trading platform BSwap and decentralized escrow and buyer protection tools BONDProtect.

A volatility spike is in store for ADA

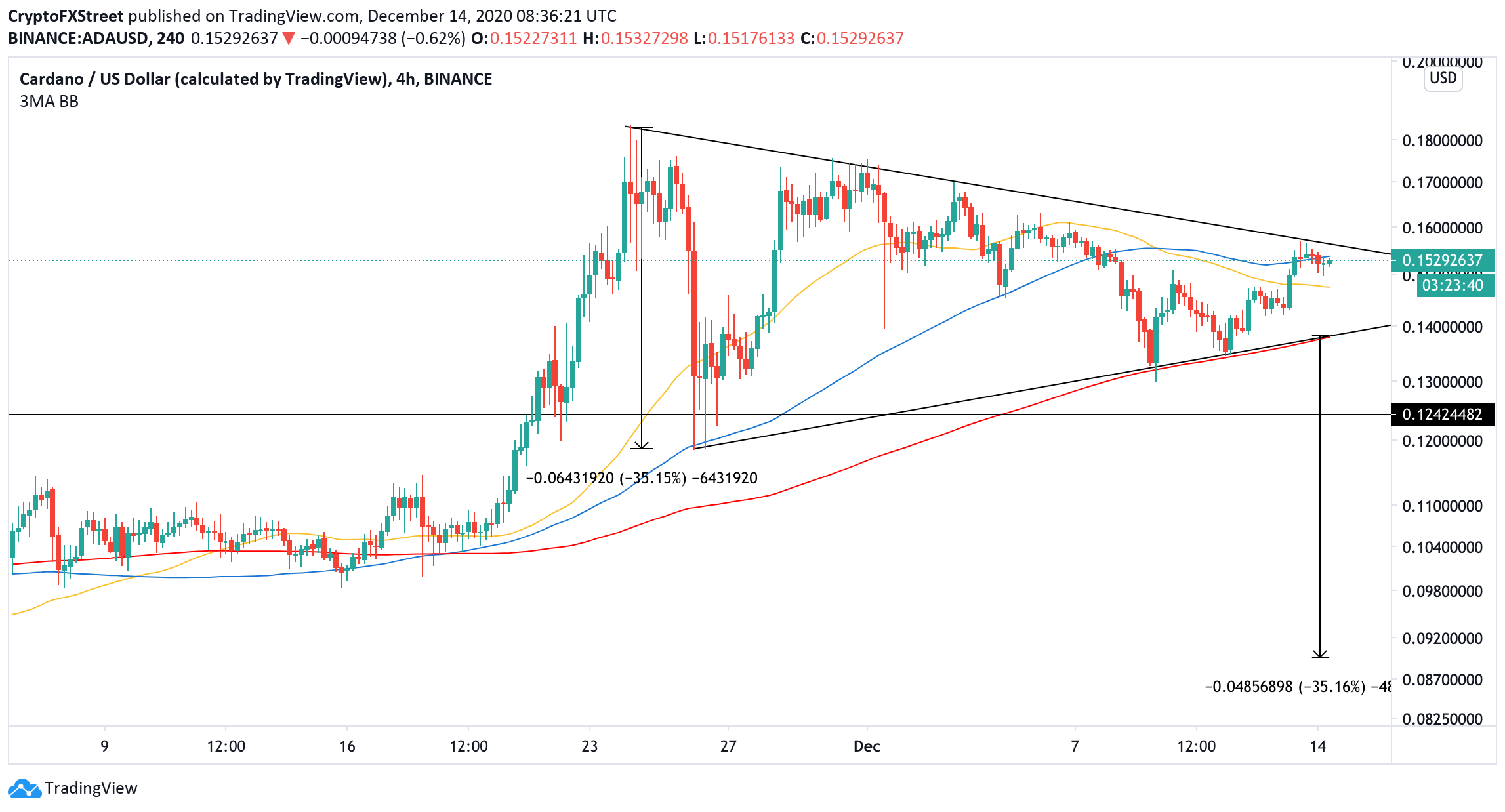

From the technical point of view, ADA is sitting inside a symmetrical triangle formation amid a high level of market uncertainty. This pattern usually occurs during consolidation periods that eventually result in a forceful breakthrough that defines the price momentum for the nearest future.

ADA’s 4-hour chart

The price touched the upper line of the triangle at $0.157 on Sunday and reversed to the downside. If the bearish momentum picks up speed, ADA may retest $0.138 before the recovery is resumed. A sustainable move below this area will signal the breakout from the triangle with the estimated target at $0.089. This move represents a 35% sell-off.

Meanwhile, IntoTheBlock’s “In/Out of the Money Around Price” model shows that over $63,000 Cardano addresses purchased nearly 4.5 billion coins between $0.141 and $0.139. This barrier coincides with the triangle support, meaning that the bears might have a hard time pushing through.

ADA In/Out of the Money Around Price

On the other hand, over 26,000 addresses purchased about 2.6 billion ADA tokens, around $0.158. This barrier creates a local resistance that needs to be taken away before the recovery gathers pace. The next bullish target is $0.20.

%20Analytics%20and%20Charts-637435327697438640.png)