Mark Carney talks after the BOE’s “Super Thursday”: the rate decision, the meeting minutes and the Quarterly Inflation Report.

Brexit is already taking some kind of toll on the economy. He also talks about the slowdown of the economy. He does not provide a more hawkish statement than the meeting minutes and the QIR.

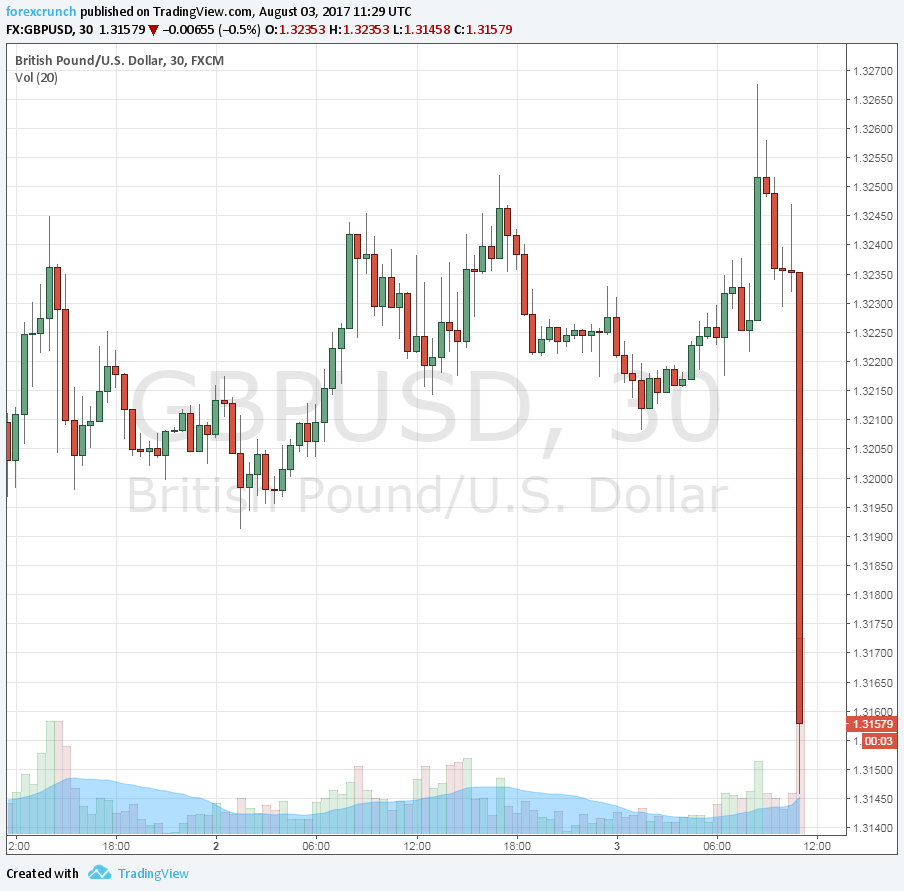

GBP/USD remains on the lower ground, around 1.3150. EUR/GBP tops 0.90.

- Investment has suffered since the Brexit vote

- Global growth has firmed in line with expectations. Trade has also grown nicely.

- Monetary policy cannot prevent the weaker real incomes likely to accompany Brexit.

- Inflation fell and is expected to peak around October. it is expected to remain a bit above target.

- With low unemployment, wages are expected to rise.

- The assumption of a smooth Brexit will be tested. The process of leaving the EU is beginning to have an impact, with some hesitation.

- The prolonged lower investment will hurt productivity.

- Economic growth is expected to remain subdued.

- Some tightening will be needed in the next three years.

Earlier, the BOE decided to leave the interest rate unchanged with a vote of 6 against 2, as expected. Perhaps some had seen the BOE raising rates.

The other messages were mixed: they changed the guidance to two rate hikes in the horizon against one beforehand. On the other hand, they downgraded some of their forecasts, especially for wage growth in 2018.

The pound reacted negatively, dropping around 100 pips from 1.3240 to 1.3145 before bouncing just a bit.