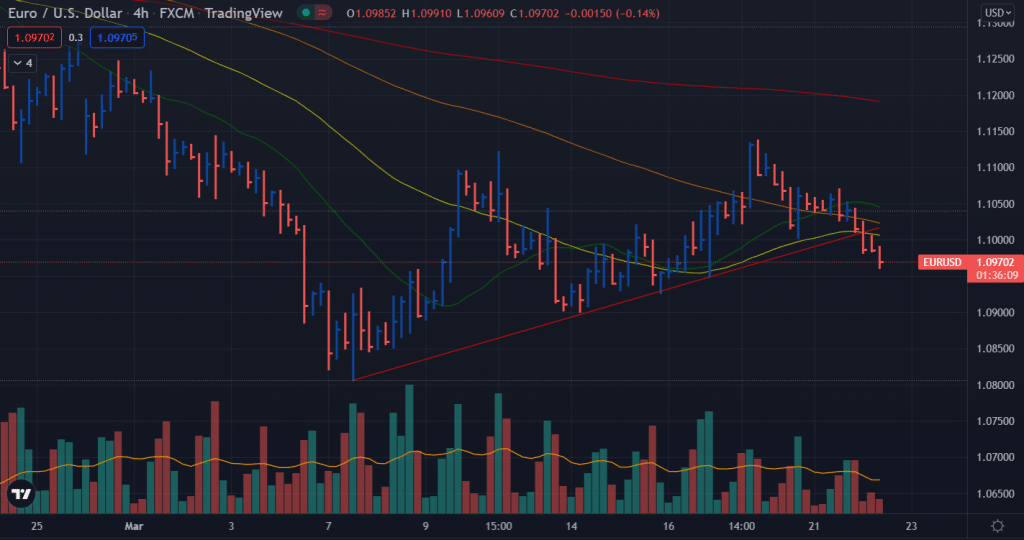

- Having broken the 2-week support level, EUR/USD has shown a downtrend.

- ECB’s Lagarde refrains from supporting the Fed as DXY hits fresh weekly high.

- As Russia avoids default and Kyiv is ready to discuss leaving NATO, Ukraine’s fears are lessening.

- The ECB and Fed announce immediate action in response to headlines about Russia and Ukraine.

The EUR/USD outlook remains negative as the pair broke below the 1.1000 mark amid the Dollar’s strength and risk aversion stemming from Russia.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Tuesday’s European morning began with EUR/USD near 1.1000, paring intraday losses. However, the pair could not hold gains and fell back to new daily lows. The major pair remains below its previous support line from March 7th, the bond market aggression weighs on the US dollar.

However, the 10-year Treasury and 2-year Treasury yields have reached new highs since May 2019, while bid prices were around 2.32% and 2.15% at press time. Fed policymakers have a dovish outlook and are worried about inflation behind these moves.

Fed’s hawkish policy

Interestingly, Atlanta Fed President Bostic and Richmond Fed President Barkin indirectly contributed to the Federal Reserve’s ability to contain inflation by signaling an accelerated rate hike. However, the Fed chair’s remark that it might raise rates by more than 25 basis points at one or more meetings provided significant impetus for Treasury coupons.

Changyong Rhee, director of the Asia-Pacific department at the International Monetary Fund (IMF), said the US has room to raise interest rates. He also mentioned that inflation in Asia is expected to peak in the second quarter of this year. It is also important to note that firmer US inflation expectations, as evidenced by a 10-year breakeven inflation rate reported by the St. Louis Federal Reserve (FRED), support stronger yields and put pressure on EUR/USD rates.

Russia’s aggression against the world

In an attempt to challenge a pair of bears, Reuters reported Russia’s second coupon payment was made alongside Ukrainian President Volodymyr Zelenskyy’s willingness to discuss Ukraine’s decision not to join NATO. Zelenskyy stated earlier that Interfax could not make an immediate decision on the occupied territory of Ukraine. US President Joe Biden also mentioned fears of a cyber attack on the United States.

ECB’s stance

In an address to the Montaigne Institute in Paris on Monday, European Central Bank (ECB) President Christine Lagarde dismissed the risks of stagflation. “The ECB’s monetary policy will be different from the Fed,” says ECB President Lagarde.

US and European stock futures are posting modest declines amid these developments, while the US Dollar Index (DXY) has risen 0.13% to 98.65, the latest reading.

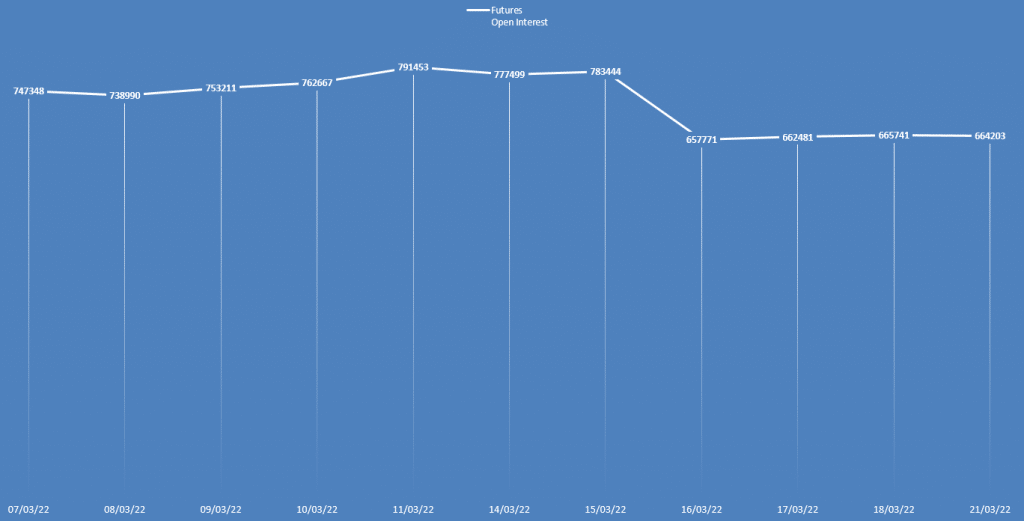

EUR/USD outlook via daily open interest

The EUR/USD price dropped yesterday, but the daily open interest did not significantly change. Therefore, it shows a neutral price action.

What’s next for EUR/USD forecast?

EUR/USD bears will closely monitor central bank comments and developments between Ukraine and Russia to tighten their grip.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

EUR/USD price technical outlook: Bulls find no respite

The EUR/USD price dropped below the 1.1000 mark, breaking the 20-period and 50-period SMAs on the 4-hour chart. The volume data suggests bearish price action and the sellers may aim for 1.0900 area. The average daily range is 54% so far, indicating higher volatility for the pair. Any upside attempt will be capped by 1.1000 resistance.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money