The recent market turmoil has already lowered the chances of a rate hike, but it is hard to see the Fed backing down.

However, Yellen may certainly be cautious. Here is the view from Credit Agricole for the Fed and for other events:

Here is their view, courtesy of eFXnews:

We expect the Fed to hike by 25bp but lower the glide path for rates in the next three years. In addition, the Fed should maintain its subdued outlook for inflation and could cut its projections for the unemployment rate. The press conference and the updated set of forecasts should be consistent with market expectations of a data-dependent but very cautious tightening cycle ahead.

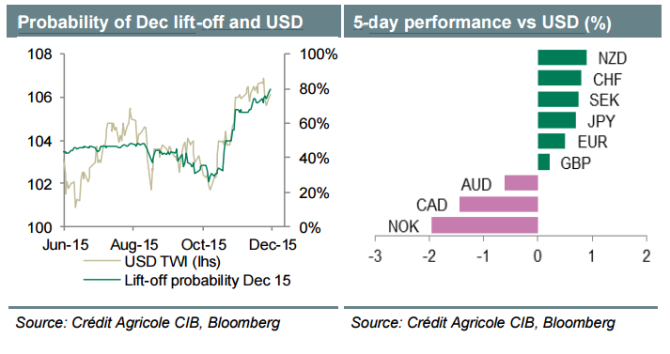

Markets are attaching an 80% chance to a December lift-off and the removal of the residual uncertainty should support USD. That said, we expect the markets to respond more strongly to changes in the Fed outlook beyond lift-off. We expect the Fed cautiousness on inflation and growth to persist, and this could mean USD will struggle to extend any gains beyond the recent highs after the meeting.

The Fed’s cautiousness could also have a negative impact on market risk sentiment, especially if it fuels global growth and inflation fears. As a result, a ‘dovish’ Fed hike could leave commodity and risk-correlated currencies vulnerable.

Potential disappointments from New Zealand GDP and Canadian CPI could weigh on NZD and CAD, respectively. NOK and SEK could suffer as well at the hands of Norges Bank and Riksbank.

USD has lost some ground against EUR, JPY and CHF of late. While a Fed lift-off could revive demand for policy divergence trades and help the USD, a renewed deterioration in market risk sentiment could prop up the G10 safe-haven currencies to a degree. We remain bullish USD against JPY and CHF as medium-term trades.

What we’re watching:

We believe the ECB will continue to lean aggressively against unwarranted FX appreciation.

EUR – Risk sentiment should prove the currency’s main driver for now.

USD – The Fed announcement may trigger a sell the fact reaction.

NOK – Further policy easing may pressure the NOK further.

JPY – Further policy easing may keep the JPY a sell on rallies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.