Manufacturing firms in the UK experienced one of the fastest growth in domestic orders ever recorded in more than two years, during the three months through January, industry data showed. The uptick in domestic orders underpinned the fact that rising consumer prices did not curb demand at the turn of last year, survey data from the Confederation of British Industry (CBI) showed last week.

The CBI survey said that the sentiment in the manufacturing sector increased as the domestic orders balance was recorded at 16, which was the highest level seen since July of 2014. The survey results also showed that export orders increased with the balance rising from -15 to +9, a sign that manufacturing firms are enjoying a boost from a weaker exchange rate which has fallen sharply since the June 23rd Brexit referendum.

The CBI survey takes into account the percentage of respondents who experienced an improvement in business against a decline. The overall picture that emerged was the manufacturers in the UK enjoyed one of the strongest demand periods for the goods, last seen since April 2015. The favorable conditions led by a weaker exchange rate prompted a wave of optimism among producers who noted that they experienced output expanding at a faster than expected pace over the next quarter.

Rain Newton-Smith, the CBI’s chief economist commented that “U.K. manufacturers are firing on all cylinders right now with domestic orders up and optimism rising at the fastest pace in two years.”

The CBI survey questioned 461 firms between the periods of December 16 through January 12.

CBI Survey: Key Findings

- Domestic orders up 16%, rising at the fastest pace since July 2014 (which registered a 23% increase)

- Export orders rose moderately up 5%

- 37% of businesses reported an increase in total orders and 21% reported a decrease, giving a balance of 16%

- 22% of manufacturers said that employment numbers were up while 18% said they were down

- Average domestic prices grew for the third quarter in a row at an above average price, up 9%

The weaker pound has brought about a mixed bag, while on one hand, British shoppers have splurged on spending, the weaker exchange rate is expected to take its toll on prices as well with producer’s input costs already rising strongly, which will eventually rub into the consumer prices. The CBI’s balance for manufacturer’s average price expectations over the coming three month period was at +28, which was the highest level over the past five years.

Consumer prices in the UK rose to a two and half year high at 1.6% in December. The Bank of England has conveyed its willingness to bear an inflation overshoot of 2% this year.

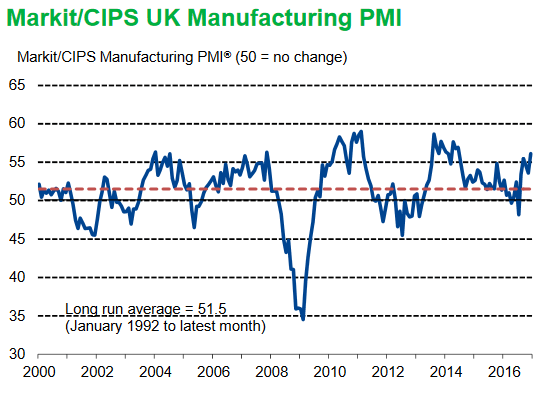

In December, the manufacturing PMI rose to a 30-month high on the strengthening of output growth and new orders, according to data from IHS Markit. The manufacturing PMI was recorded at 56.1 led by improved domestic and overseas demand. Price pressures remained elevated during the month but eased from recent highs.

UK Manufacturing PMI, December 2016: 56.1 (Source: IHS Markit)

This coming week will be important for the British pound as the new month marks a fresh set of economic data. IHS Markit will be releasing the manufacturing PMI numbers on Wednesday for the month of January while a day later on Thursday the Bank of England will be holding its first monetary policy meeting of this year.

No changes are expected to interest rates at this meeting, but the BoE could strike a hawkish tone as far as inflation is concerned. Many experts believe that the BoE could be seen reducing its asset purchase program which stands at £435 billion before interest rates are pushed higher.