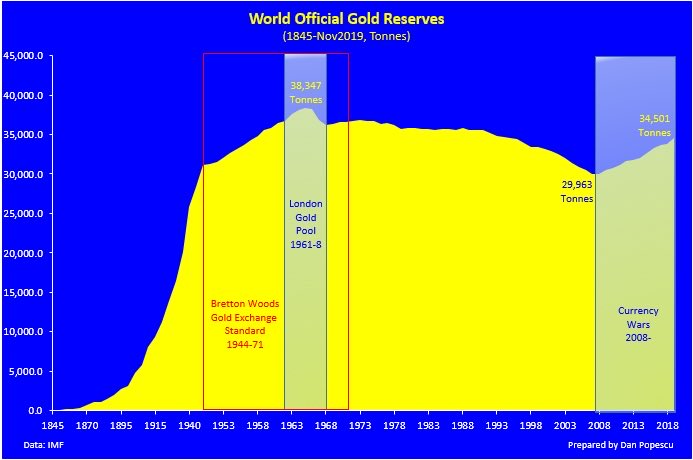

Central banks have purchased 4,538 tonnes of gold since 2008 and have recovered more than half the amount they sold between 1965 and 2008,

Jeroen Blokland, portfolio manager for the Robeco Multi-Asset funds, tweeted on Dec. 30.

The world official gold reserves fell from 38,347 tonnes in 1964 to 29,936 tonnes in 2008 and stood at 34,501 tonnes at the end of last month, according to the chart prepared by popular analyst Dan Popescu.

The rise in the official gold reserves likely represents the speeding up of the de-dollarization process by Russia, China, and Europe, as noted by mises.org in September.

Gold prices could benefit from continued de-dollarization over the long run. At press time, the yellow metal is trading at $1,520, representing an 18.66% yearly gain.