In light of the latest CFTC positioning report in the week to July 17:

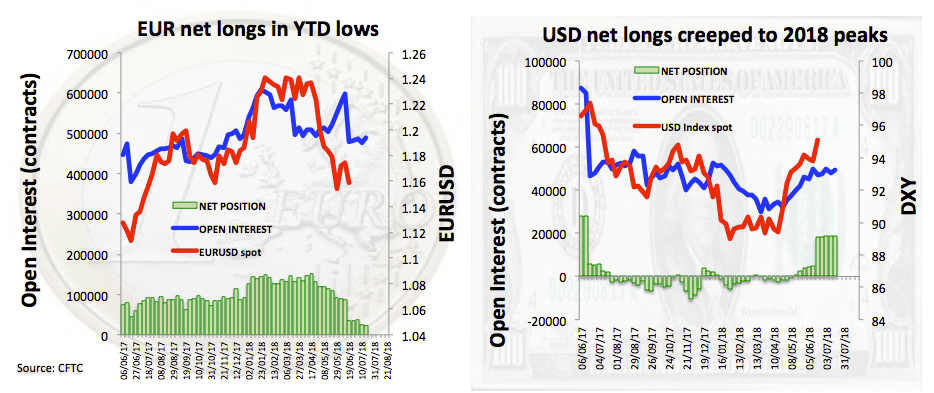

- Speculators kept scaling back their EUR long positions, with net longs hitting fresh YTD lows at 21.4K contracts during the week ended on July 17.

- Totally the opposite occurred on the USD-side, where speculative net longs climbed to fresh yearly peaks around 18.9K contracts. The up move in DXY to fresh peaks in the 95.60/65 band has been partially eroded following comments from President Trump on the buck and the Federal Reserve, although the decline appears well supported around today’s lows in the 94.20 area.

- JPY net shorts increased further to levels last seen in March 13, while USD/JPY clinched tops beyond 113.00 the figure during last week. However, it will be interesting to see investors’ reaction to rising speculation on the BoJ ahead of next week’s meeting.

- GBP net shorts barely changed, staying in the negative territory for the fifth week in a row and always under pressure stemming from the omnipresent uncertainty around PM May’s government and lack of significant progress in the Brexit negotiations.

- VIX net shorts rose further to around 71.8K contracts, levels last seen in late January and before the sudden change of sentiment that pushed the ‘panic index’ to peaks just beyond the 50.0 milestone, levels last recorded in August 2015.