These are the main highlights of the latest CFTC Positioning Report for the week ended on February 18th:

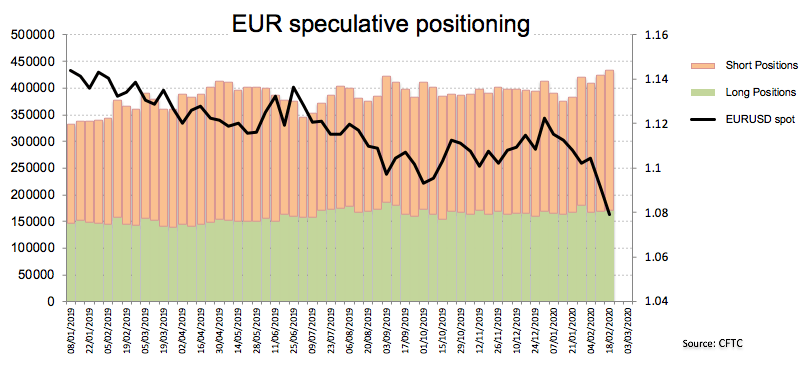

- Speculators added more contracts to their already multi-month net short position during last week, taking it to the highest level since late May 2019 at around 91.5K contracts. Poor results from the euro docket vs. a resilient US economy added to the view of a ‘looser for longer’ ECB, all in combination with unabated concerns around the COVID-19 have been playing heavily against EUR as of late.

- Exactly on the opposite side, USD net longs rose to the highest level since November 19th 2019, as the speculative community continued to seek shelter in the greenback amidst unremitting fears surrounding the Chinese coronavirus. Also lending support to the buck, US data releases kept surprising to the upside, sustaining the “appropriate” stance from the Fed, while market participants appear to have started to price in the likeliness of a steady Fed for the foreseeable future (say no further “insurance” cuts this year).

- Net longs in the British pound increased to 5-week highs on the back of speculations that some sort of fiscal stimulus package could be in the pipeline. However, this could prove to be insufficient to sustain some lasting recovery in the quid against the backdrop of a cautious BoE, political uncertainty and upcoming tough EU-UK trade negotiations (due to start in March).