These are the main highlights of the CFTC Positioning Report for the week ended on May 11th:

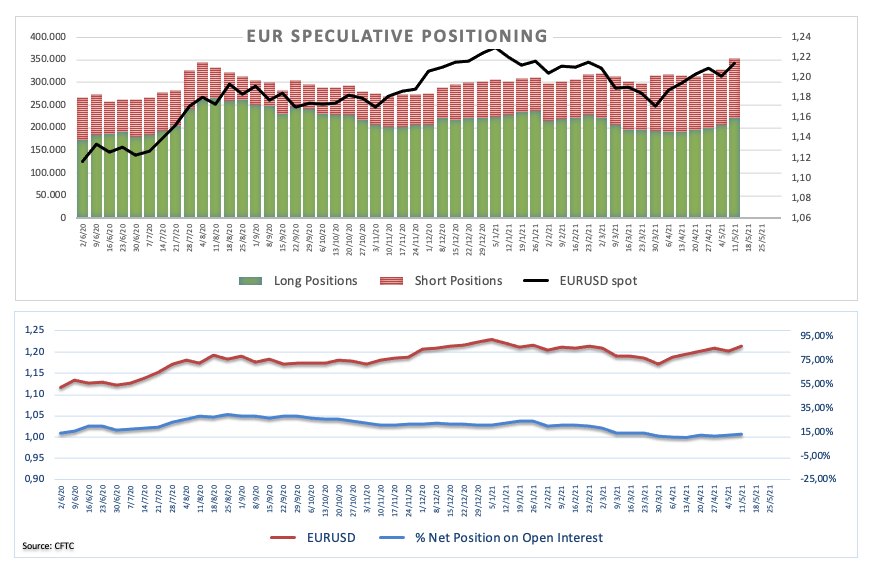

- Speculators markedly increased their gross longs positions in EUR for the fourth consecutive week, taking net longs to levels last seen in early March. Increased optimism on a full re-opening of the economy appears supported by the improved pace of the vaccination campaign, all amidst the steady hand of the ECB.

- Net longs in USD ticked higher to 2-week highs along with rising open interest and the decline in the US Dollar Index (DXY). Diminishing US yields coupled with the confirmation of the dovish stance at the Fed’s event in late April weighed on the buck. Occasional bouts of strength in the dollar came on the back of the sharp rebound in volatility (gauged by the VIX index).

- GBP gross longs rose considerably and took the net position to 2-week highs. Rising hopes on a strong recovery of the UK activity, the firm pace of the vaccine rollout and the shift of the Bank of England (BoE) to a less-dovish stance have all lent support to the quid. The uptick in Cable to levels beyond 1.4100 echoes this view along with the selling pressure in the dollar.

- Net longs in Gold increased to levels last seen in late February. The downtrend in US yields lent wings to the precious metal and finally pushed the ounce troy above the key $1,800 mark.