These are the main highlights of the CFTC Positioning Report for the week ended on March 31st:

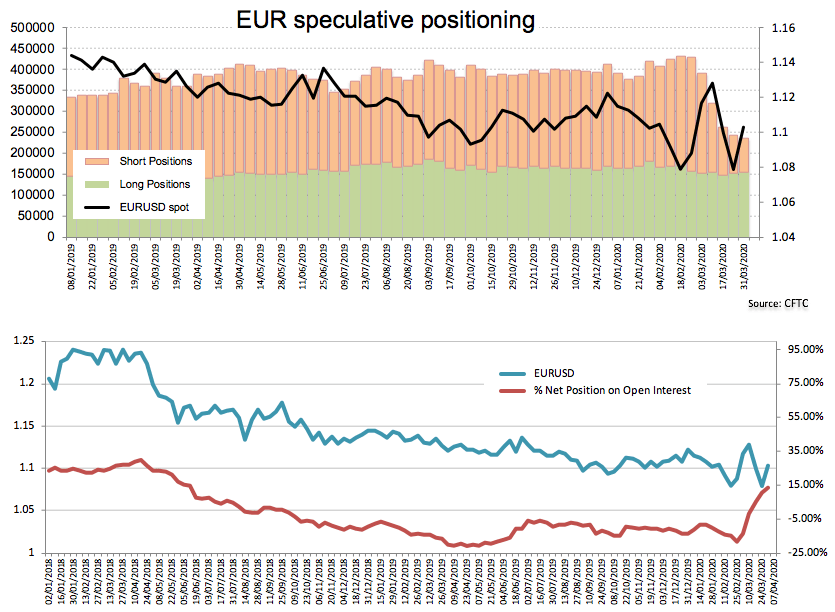

- Speculators added EUR gross longs for the third consecutive session during the week ended on March 31st, taking the net longs to the highest level since mid-June 2018. The positive figures from the region’s Current Account appears to be supporting the inflows into the single currency. Of note is that the percentage of net longs vs. open interest climbed to levels last seen nearly 2 years ago, opening the door to some correction in the short term.

- VIX (aka “the panic index”) net shorts receded to the lowest level since January 2019, as the initial panic over the impact of the coronavirus on he global economy seems to have subsided somewhat.

- Net longs in GBP dropped to just below 5K contracts, levels last seen in late November 2017, as gross longs have been retreating for the last five consecutive weeks. The looser monetary stance from the BoE in combination with the fragile current account position and unabated Brexit concerns seem to have been far too much for the sterling to cope with.