These are the main highlights of the CFTC Positioning Report for the week ended on October 27th:

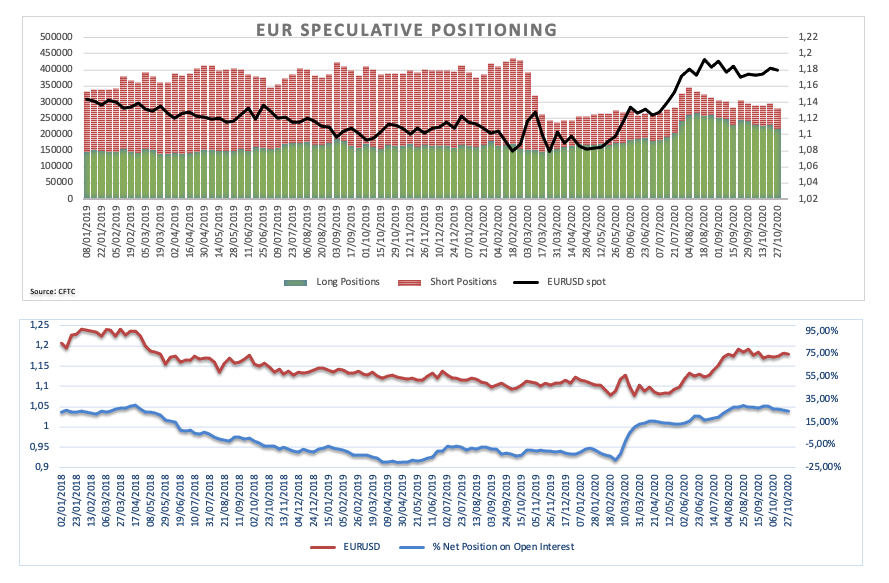

- Speculators reduced their euro net longs positions to levels last seen in mid/late July pari passu with rising concerns over the impact of the second wave of the coronavirus pandemic on the region’s economic prospects. The expected dovish tone at the ECB event also collaborated with the reduction of long positions.

- USD net shorts dropped to 2-week lows following markets’ perception that any further US stimulus will have to wait after past the November elections. In addition, the rapid increase of COVID cases across the world also lent support to the buck.

- Net shorts in the sterling climbed to 2-week high as market participants remain sceptical regarding the handling of the coronavirus crisis by Number 10 amidst rising cases and restrictions. Furthermore, political jitters and stagnant progress around the EU-UK negotiations talks also added to the quid’s woes.