These are the main highlights of the CFTC Positioning Report for the week ended on April 7th:

- Net longs in the sterling dropped to the lowest level in almost two years, as investors faded the rally observed in late March. Furthermore, the coronavirus outbreak picked up pace in the UK, forcing market participants to revise down initial growth prospects as well as the potential impact on the economy

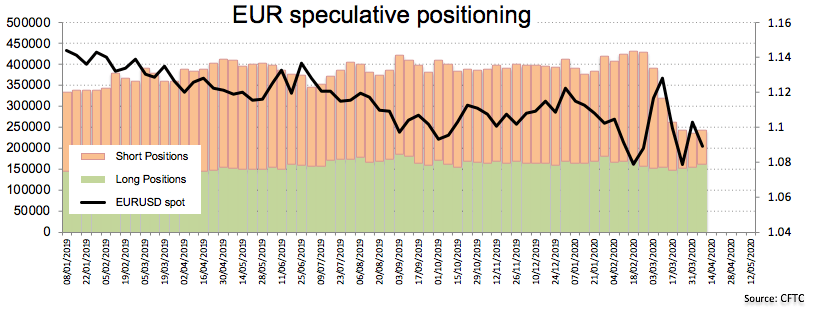

- Speculative net longs in EUR remained in levels last seen in June 2018, as Italy and Spain appear to have left behind the worst of the COVID-19 pandemic. In addition, speculators kept unchanged the optimism ahead of the Eurogroup meeting (and eventual agreement).

- Crude Oil net longs climbed to the highest level since January 21st on the back of rising hopes of an output cut deal between the OPEC+ and several oil producers. The extreme oversold conditions of the market could have also played a role in the rebound.