These are the main highlights of the CFTC Positioning Report for the week ended on June 2nd:

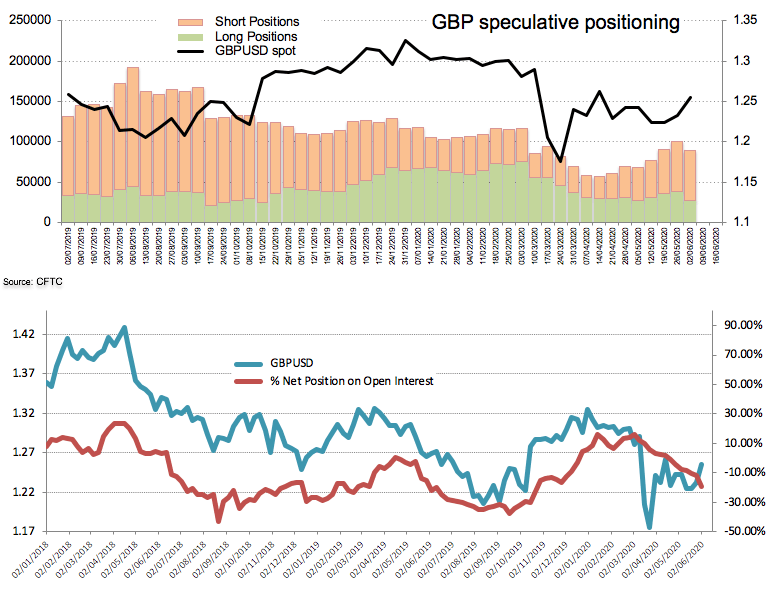

- Speculators increased their shorts in the British pound for the seventh week in a row, taking the net shorts to the highest level since late November 2019. In fact, uncertainty around the impact of the coronavirus on the UK economy plus renewed Brexit concerns and the possibility of further easing by the Bank of England kept weighing on investors’ sentiment towards the sterling for yet another week.

- Net longs in the EUR went down to a 4-week low ahead of the ECB meeting last Thursday. The overbought conditions vs. the greenback plus the recent risk-rally could have motivated investors to cash out part of the strong gains recorded in past sessions.

- USD net longs receded to the lowest level since mid-March. The change of heart among investors favouring the riskier assets in detriment of the safe haven universe put the buck under heightened pressure during last week, forcing at the same time the US Dollar Index to intensify the correction lower. By the same token, net longs in JPY retreated to 2-week lows.