These are the main highlights of the CFTC Positioning report for the week ended on July 23:

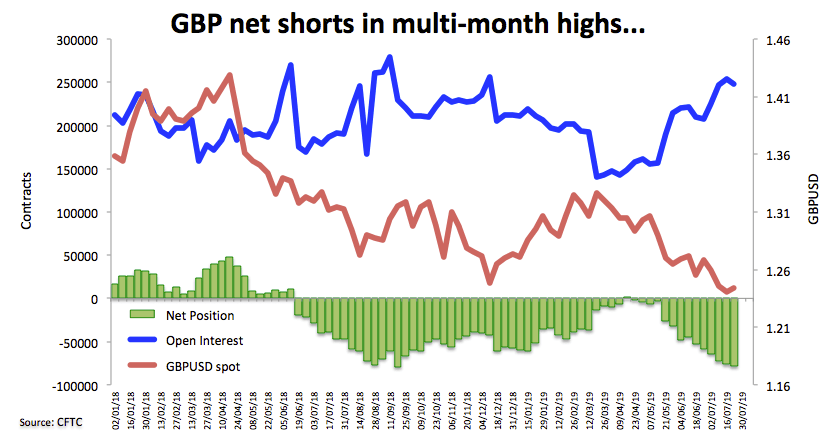

- Speculative net shorts in GBP climbed to the highest level since mid-September 2018 following increasing uncertainty in the UK political scenario and absence of progress on the Brexit front. The possibility of a ‘hard Brexit’ has also weighed on investors’ sentiment.

- CAD net longs kept increasing and are now at the highest level since February 13 2018, confirming the change of heart around the Canadian Dollar on the back of solid labour market prints, robust inflation performance and the neutral/cautious stance from the Bank of Canada in opposition to the dovish twist in other central banks of the commodity-bloc, namely the RBA and the RBNZ.

- The speculative community added EUR shorts to their already negative positions around the single currency, taking net shorts to 4-week highs ahead of the expected dovish tone from the ECB at its event.