These are the main highlights of the latest CFTC Positioning Report for the week ended on October 15th:

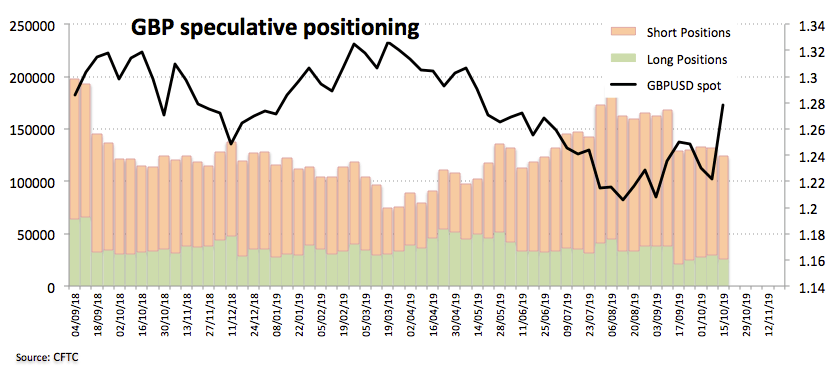

- Both gross longs and shorts in GBP went down during last week, although that was enough to drag the net short position to the lowest level since July 2nd, always on the back of rising hopes of a Brexit agreement. Ultimately, the UK and the EU reached a deal after the cut-off date, although uncertainty still persists.

- Speculators sold the Japanese safe haven JPY and pushed it back to the negative territory for the first time since late July. The better tone in the broader risk-appetite trends continued to sustain the outflows from the safer assets.

- USD gross longs/shorts shrunk for the second consecutive week, taking the net longs to 5-week lows. Deteriorating US data releases, the ‘Phase One’ deal between the US-China and the improved sentiment in the risk complex hit the mood in the buck during last week.