These are the main highlights of the latest CFTC Positioning Report for the week ended on November 19th:

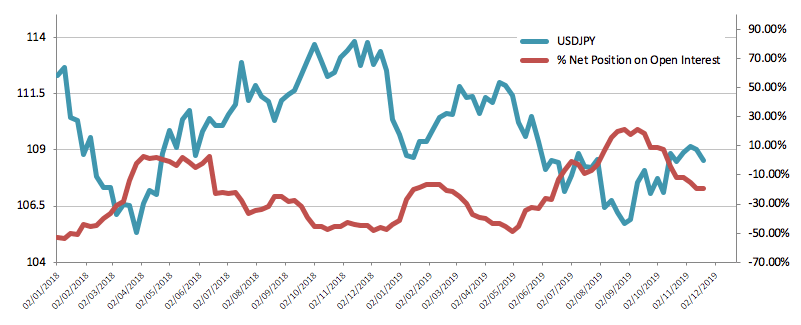

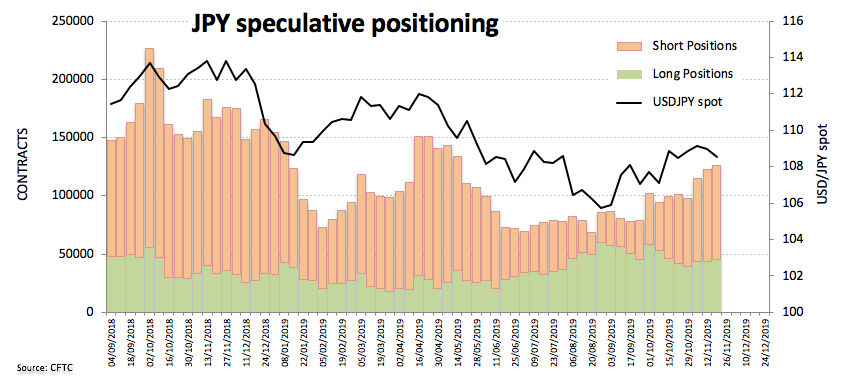

- Speculations of a positive outcome from the US-China protracted trade war continued to sustain the exodus from the Japanese safe haven for yet another session, taking JPY net shorts to the highest level since June 11th. In the meantime, President Trump recently reiterated that a deal looks ‘close’ in spite of the stagnant negotiations around the ‘Phase One’ deal.

- Speculators kept scaling back their gross longs in USD, taking the net longs to the lowest level since mid-July amidst alternating risk-appetite trends. In addition, market participants seem unconvinced by the ‘wait-and-see’ stance from the Fed and could be anticipating further rate cuts in the next months, leaving the buck somewhat vulnerable.

- EUR net shorts climbed to fresh multi-week highs as investors shifted their focus to the region’s weak fundamentals. This view was also reinforced by the dovish tone from ECB’s C.Lagarde early last week.