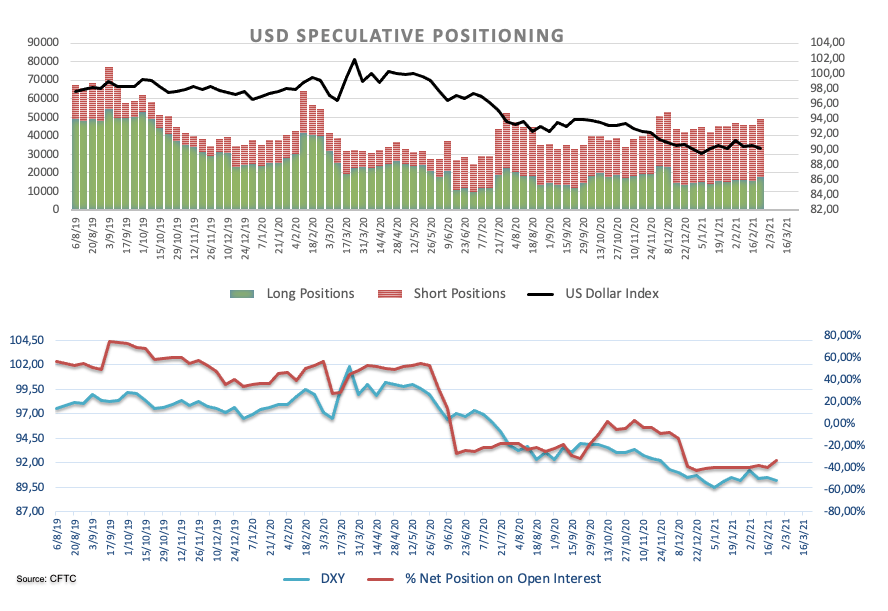

These are the main highlights of the CFTC Positioning Report for the week ended on February 23rd:

- Speculators reduced their net shorts in the US dollar to levels last seen in early December 2020 around 13.8K contracts. Investors seem to be changing their view on the buck in response to potential higher inflation in the next months coupled with the firm pace of the vaccine rollout and the idea of a strong economic performance in the wake of the pandemic.

- Net longs in the British pound rose further and climbed to levels last observed almost a year ago. Auspicious news stemming from the UK’s vaccine rollout in combination with improved growth prospects and an upbeat view from the Bank of England at its latest event lent extra legs to the so far positive momentum surrounding the sterling.

- JPY net longs receded to almost 4-month lows in response to the latest pick-up of yields in the US bond markets as well as the investors’ bias towards the risk complex.

- Shifting to the precious metals, net longs in Gold dropped to levels recorded in early June 2020 following the rebound in inflation expectations, the subsequent raise in US yields and the extra support to the dollar.