These are the main highlights of the CFTC Positioning Report for the week ended on January 26th:

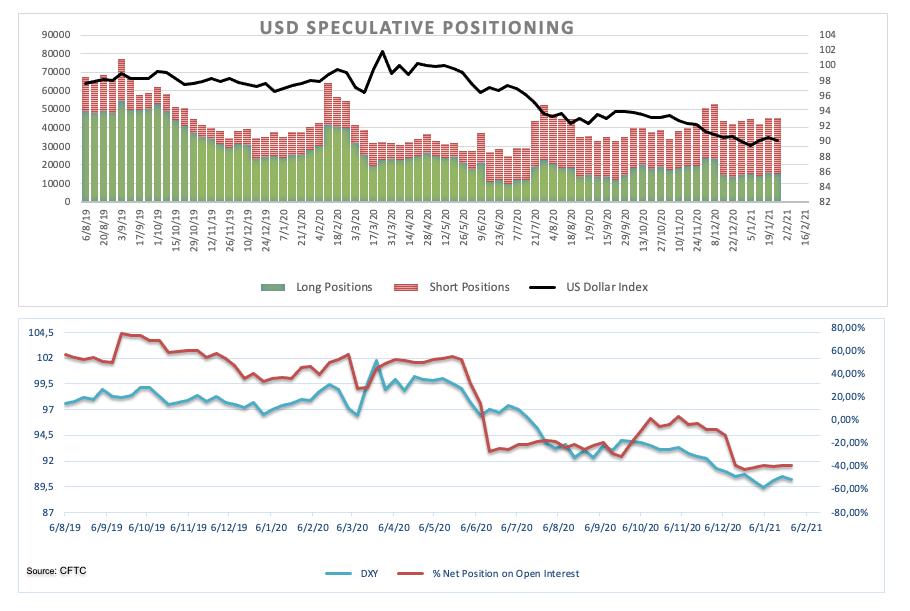

- Net longs in USD climbed to 3-week highs. The sentiment around the dollar remains sour, as the Federal Reserve reinforced its ultra-accommodative stance and prospects of extra US fiscal stimulus remain firm.

- The speculative community reiterated its positive view on EUR, pushing net longs to the highest level since mid-October 2020. The neutral/upbeat message from the ECB plus solid growth prospects in the region (in spite of the slow vaccine rollout) continued to lend support to the European currency.

- Net longs in JPY receded to levels last seen in December following the better perspective in the risk complex and the retracement in US yields.

- Traders scaled back their positions in crude oil and pushed net longs to multi-month lows. Demand fears have re-emerged on the back of fresh lockdown measures in China and the relentless advance of the pandemic in Europe (helped by the slow pace of the vaccination campaign).