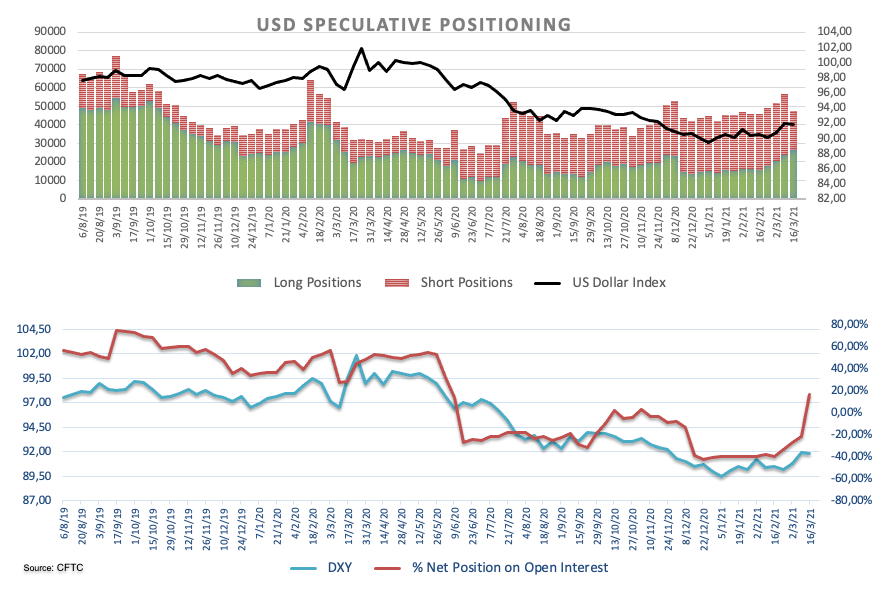

These are the main highlights of the CFTC Positioning Report for the week ended on March 16th:

- Speculators added gross USD longs for the fifth consecutive week, pushing the net positioning back to the positive ground for the first time since early November 2020. Higher yields stemming from investors’ perception of a pick-up in inflation in the upcoming months continued to lend legs to the buck coupled with rising bets of a strong rebound in the US economy now sooner than previously estimated.

- EUR net longs shrunk for the fifth week in a row to levels last recorded in June 2020 around 90K contracts. The slow vaccine rollout in the Old Continent in combination with fresh lockdown measures and some signs of a third wave of the pandemic accentuated the exodus from the single currency. The soft hand of the ECB (inaction?) appears to have also collaborated with this trend.

- Higher US yields have been also undermining the demand for the safe haven (low yielders) JPY and CHF. In fact, the Japanese yen turned net short for the first time since March 3 2020, while net longs in the Swiss currency dropping to levels last seen in late June 2020.