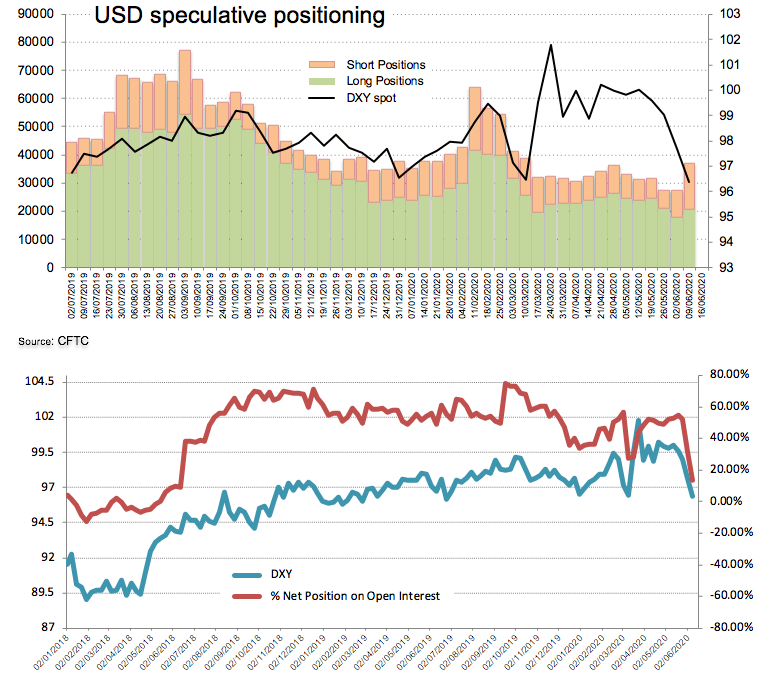

These are the main highlights of the CFTC Positioning Report for the week ended on June 9th:

- Investors increased their gross shorts in USD during the week ended on June 9, forcing net longs to recede to the lowest level since mid-June 2018. In fact, investors’ preference for riskier assets played against the buck during this period, despite fears of a second wave of the COVID-19 and the Fed’s negative view on the US economy gave the dollar some support after the cut-off date.

- By the same token, EUR net longs rose to levels last seen on May 22 2018 pari passu with the sharp improvement in the risk-associated complex.

- Net longs in the Japanese yen also shrunk to the lowest level since early March, always on the back of the rising optimism in the risk universe.

- AUD net shorts went down to 4-week lows following better-than-expected data releases in China, positive prospects regarding the recovery of the Australian economy and the steady stance in the RBA.