These are the main highlights of the CFTC Positioning Report for the week ended on September 3rd:

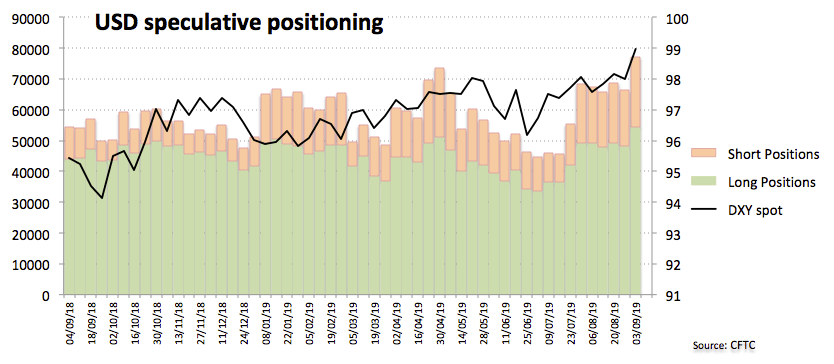

- Investors added longs to their already positive positions in USD, taking net longs to the highest level since March 12, as concerns over a probable recession in the US economy eased somewhat while further easing by the Fed appears almost priced in.

- CAD net longs receded to the lowest level since early July on the back of rising speculations of a dovish tone at the BoC meeting on September 4 (a day after the cut-off date), all supported by the escalation in tensions in the US-China trade war.

- GBP net shorts dropped to multi-week lows following the somewhat better tone around the Sterling. Despite uncertainty around UK politics remains far from dissipated, a Brexit ‘no deal’ scenario seems to be losing traction now as well as the likeliness of snap elections in mid-October.