These are the main highlights of the CFTC Positioning Report for the week ended on April 13th:

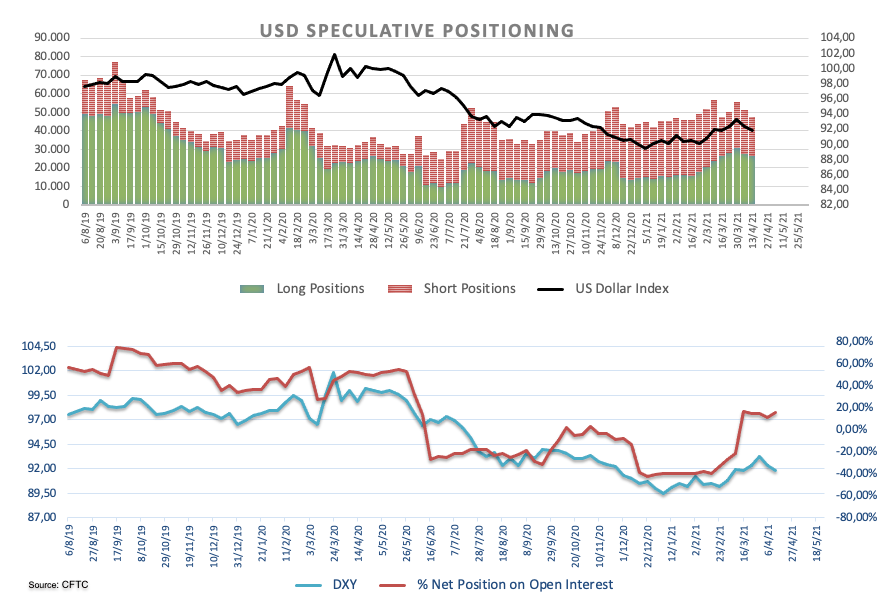

- Speculators trimmed both their gross longs and shorts positions in the dollar, taking the net longs to the highest level so far this year. However, diminishing US yields weighed on the USD and dragged the US Dollar Index (DXY) further south of the key 200-day SMA. In addition, investors appear to have already priced in the positive US growth outlook in combination with the solid pace of the vaccination campaign, re-shifting their interest to growth prospects overseas.

- Net longs in EUR eased for yet another week, this time to levels last recorded in late March 2020, amidst some steady activity in gross shorts. Shrinking sentiment around the greenback, renewed optimism in the economic recovery in the euro area and the improved pace of the vaccine rollout have all underpinned the push higher in spot to the doorsteps of the key 1.2000 region, gaining around 3 cents since late March lows in the 1.1700 neighbourhood.

- Net longs in the British pound rose to 3-week highs amidst rising open interest. Profit taking mood dragged Cable to as low as the 1.3700 region, where some decent contention seems to have emerged. Optimism on the performance of the UK economy in the post-pandemic era coupled with the steady stance from the BoE is expected to lend extra oxygen to the quid, although persistent Brexit uncertainty forecasts a bumpy road ahead for the currency.

- Safe havens like the JPY and the CHF saw their net shorts rising to 2-week highs and net longs retreating to the lowest level since early March 2020, respectively, all against the backdrop of the improvement in the risk-complex.

- Net longs in Crude Oil eased to multi-month lows amidst the generalized erratic performance in place since late March. Prices of the commodity barely reacted to the OPEC+ decision on April 1st to start adding production in the near-term, while traders keep looking to the progress of the economic rebound outside the US and the impact on oil demand.