These are the main highlights of the CFTC Positioning Report for the week ended on November 24th:

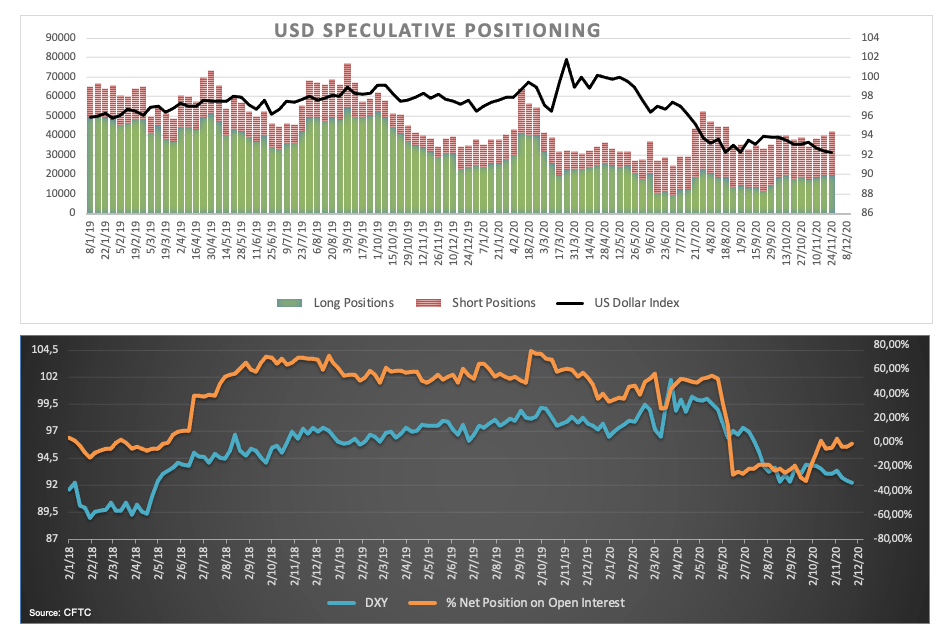

- Speculators pushed the dollar further into the negative territory, with net shorts climbing to the highest level since early October around 2.7K contracts. Prospects of an effective vaccine coupled with rising optimism on extra US stimulus sponsored that change of heart in the dollar among investors.

- EUR net longs partially reversed the previous decline and rose to 3-week highs on the back of the generalized improvement in the risk complex, also underpinned by hopes of a strong recovery in the euro area and the global economy.

- Net shorts in the British pound eased to 3-week lows on the back of the better momentum surrounding the riskier assets and some positive headlines regarding the EU-UK Brexit negotiations. However, the outlook for the sterling is seen under scrutiny on the back of still inconclusive Brexit talks, political uncertainty and the impact of the pandemic on the UK economy.

- Net longs in Crude Oil increased to levels last seen in early August as traders continue to see past the pandemic and expect a strong pick-up in the demand for the commodity in the next months. Rumours that the OPEC+ could delay its planned oil output increase have been also adding to the sentiment.