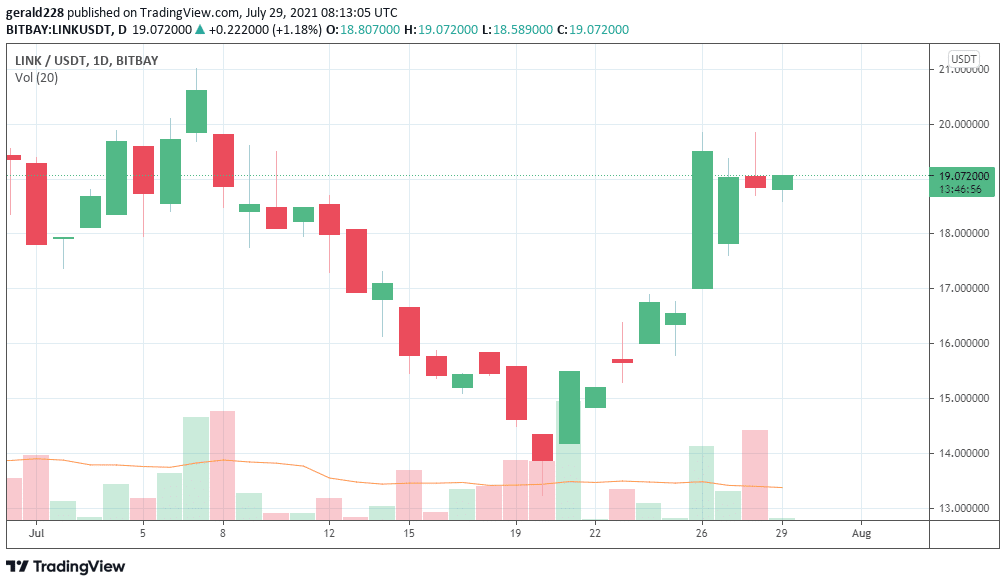

The Chainlink price has been in strong recovery mode of late with a substantial 30% rise since its July 20 low. With a number of announcements also making news, it seems that the Chainlink project is destined for further bumps in its price.

However, the past few days have been in bearish territory for the Chainlink price. This might suggest that it is consolidating at around the $18.50-$19 range to once again make a charge towards the $20 mark that was rejected 48 hours ago.

If you haven’t yet bought some LINK then this How To Buy Cryptocurrency Beginner’s Guide would be a good place to start off.

Short Term Price Forecast For Chainlink: Looking To Go Beyond $20

The Chainlink price had sank to a low of $13.58 on July 20 but recovered with a substantial 35% jump to reach the $19.50 level on July 26. After some selling pressure, LINK moved slightly downward with an 8% drop to the $18.50 level although there was also strong support at this level.

The recent rise mirrors what occurred on June 20 when a supply zone was created ranging from $19.30 to $21.05 That was followed by a substantial crash of around 30% to the $15 level. With the price now standing at just over the $19 mark, a bearish thesis could see the Chainlink price come down to the support level of $16.20. That is likely to be followed by a strong buying impetus.

If bullish momentum returns then LINK is expected to settle at around $19.30 before the next big push upwards. Resistance levels of $21.30 and $22.05 are the next likely candidates for pauses.

If you haven’t yet bought some cryptocurrency, take a look at these Best Cryptocurrency Brokers.

LINK VRF Integration Continues To Make It Attractive

The positive announcements for LINK continue to come in thick and fast. Polywhirl, which is a decentralized and private transaction ecosystem, recently announced an integration with the Chainlink VRF (Verifiable Random Function) on the Polygon blockchain.

This partnership will allow the eco-system to have a tamper-proof, auditable and reliable source of randomness. The announcement stated that Polywhirl shall be able to autonomise and provide a fair opportunity to buy back WHIRL tokens and to eventually burn them through the PolyWhirl protocol fee.

Chainlink also announced a partnership with MyCryptoCheckout where it integrated LINK price feeds with the peer-to-peer cryptocurrency payment gateway. According to the announcement, these feeds provide the payment platform with tamper-proof, reliable, high-quality price data that’s secure and up to date.

As the announcements continue coming in, its clear that the Chainlink price will be positively impacted by such developments. Long term forecasts have LINK once again reaching the $40-$45 mark by the end of the year.

Looking to buy or trade Chainlink now? Invest at eToro!

Capital at risk