- Chainlink is getting ready for a massive breakdown amid the formation of a descending triangle.

- The network is looking forward to the next step in scalability with the launch of Off-Chain Reporting.

- The IOMAP reveals increased resistance ahead of LINK, which adds weight to the retracement.

- The MACD supports a bullish outlook suggesting that bulls still have a chance to take control of the trend.

Chainlink seems to have found formidable support following the persistent retreat from highs around $36. Buyer congestion at $22 has played a key role in the ongoing recovery. However, with the formation of a descending triangle pattern, LINK is looking forward to a significant breakdown.

Chainlink is working toward the Oracle network upgrade

Chainlink has announced the development of an Off-Chain Reporting (OCR). The protocol will improve the existing Oracle network, the FluxAgrregator model and increase decentralization and scalability. According to the developers:

All nodes communicate using a peer-to-peer network. During the communication process, a lightweight consensus algorithm is run, in which every single node reports its price observation and signs it. A single, aggregate transaction is then transmitted, saving a significant amount of gas.

Chainlink is vulnerable to declines

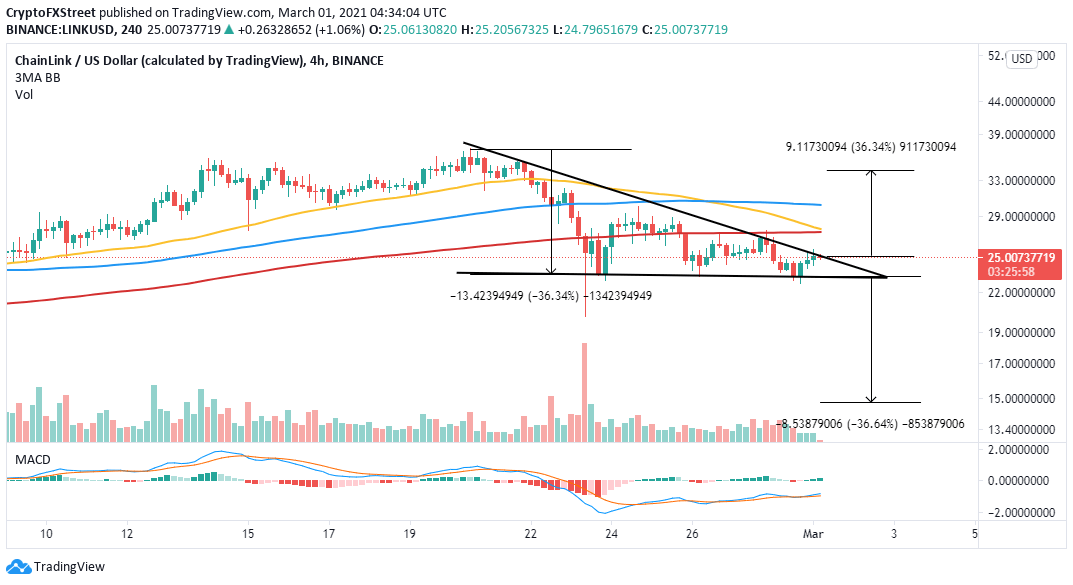

Chainlink is trading at the apex of a descending triangle. This pattern usually gives a bearish impulse and suggests that LINK may be heading into a 36% downswing to $15. The triangle is a continuation pattern suggesting that the live price feed Oracle token will drop further.

Note that the 50 Simple Moving Average (SMA) on the 4-hour chart is likely to slice through the 200 SMA, bringing to light a death cross. Realize that the death cross is a bearish pattern formed when a shorter-term moving average crosses below a long-term moving average. In other words, this pattern would add credence to the bearish outlook.

LINK/USD 4-hour chart

The IOMAP model by IntoTheBlock reveals that recovery back to the all-time high at $36 will not come easy, especially with the swelling resistance ahead of LINK. The region between $27 and $28 is the most robust seller congestion zone, where nearly 4,000 addresses had previously bought around 21.4 million LINK.

On the flip side, the same model highlights support above $20, suggesting that Chainlink could be stuck in consolidation before another major move. The most significant support runs from $21 to $22. Here, approximately 11,000 addresses had previously bought roughly 22.5 million LINK.

Chainlink IOMAP chart

Looking at the other side of the fence

It is important to realize that there are instances when the descending triangle results in a bullish impulse. Buyers need to double-down their effort and purpose to break above $30, bringing Chainlink out of the woods. Moreover, the Moving Average Convergence Divergence (MACD) shows that a bullish uptrend is building.

-637501726486400995.png)