- Chainlink technical picture worsened after a move below daily EMA100.

- LINK’s exchange supplies remain low, meaning that holders are in no hurry to sell coins.

Chainlink (LINK) extended the decline and touched $11.22, the lowest level since November 26. Despite the sell-off, LINK is still the seventh-largest digital asset with a current market capitalization of $4.7 billion. The coin has lost over 7% in the recent 24 hours and 12% on a week-to-week basis.

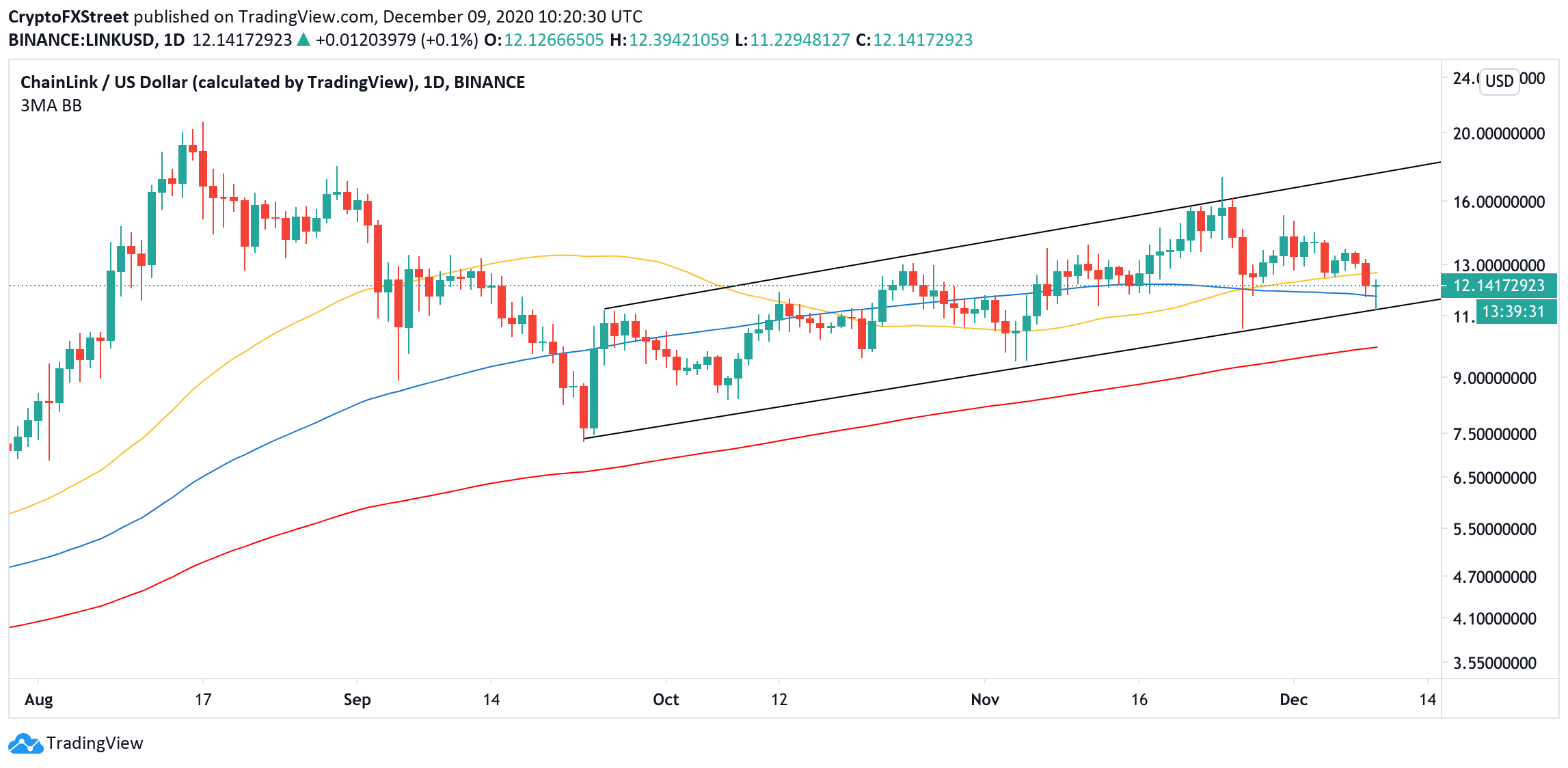

A move below daily EMA100 bodes ill for the bulls

LINK recovery from $10.55 (November 26) pushed the price above $15, however, the upside momentum was not sustained as the coin resumed the decline and broke below the daily EMA50 and EMA100. The price reached important support of $11.30 created by an upward trendline. A sustainable move below this area will increase the downside pressure and bring back psychological $10, followed by daily EMA200 at $9.8, into focus.

LINK’s daily chart

The short-term technical picture reflects increased bearish pressure. However, the on-chain metrics give bulls a glimpse of hope.

LINK holders are in no hurry to sell

Chainlink supply on the cryptocurrency exchanges stays close to the all-time low levels of 7.24%, meaning that the market is still in the accumulation phase. Traders usually start moving their coins to the exchange wallets before the dump; meanwhile, the low or decreasing exchange supplies mean that the selling pressure is receding.

LINK supply on top cryptocurrency exchanges as a percentage of the total supply has been melting down since the beginning of September. The metric has created a substantial divergence with the price, signalling that the coin is well-positioned for a rebound.

LINK supply on the cryptocurrency exchanges

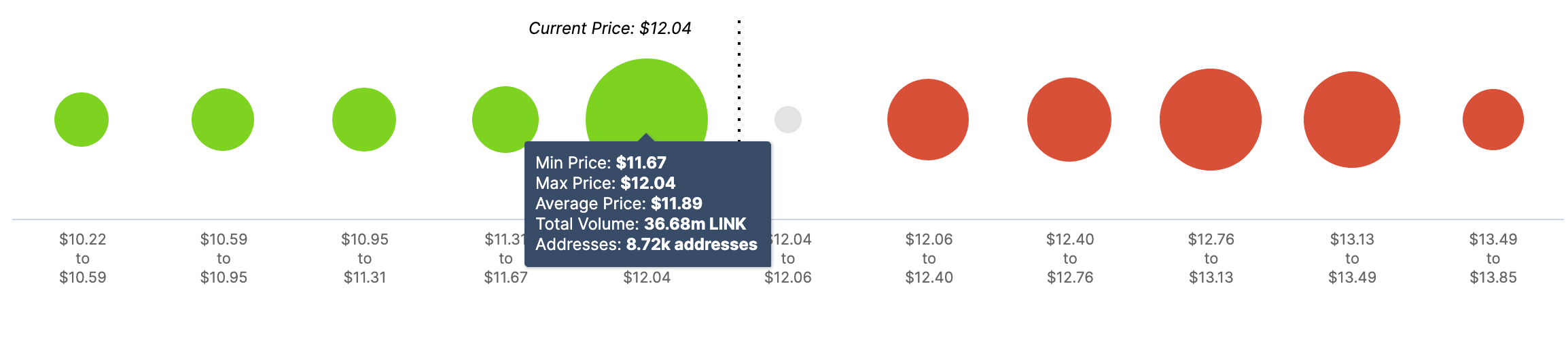

Moreover, IntoTheBlock’s “In/Out of the Money Around Price” model shows that LINK sits on top of a significant support area. Over 8,700 addresses previously purchased over 36 million LINK tokens between $11.67 and $12.03, meaning that this barrier can slow down the bears and trigger a recovery towards the local resistance of $12.40, as 5,600 addresses bought over 11 million LINK tokens around that level.

LINK In/Out of the Money Around Price

However, an even stronger barrier comes on the approach to $13. Once it is cleared, the bulls won’t face any stiff resistance until $18.

%20%5B13.06.37,%2009%20Dec,%202020%5D-637431068614106671.png)