- USD: The housing starts data showed a slight dip in November, but the broad trend has been encouraging. Dollar could wobble a little if we don’t recover from the 861k reading seen in November.

- JPY: Note that production data is out Friday morning and whilst this may not normally be a big event for the yen, in the run-up to a more active/aggressive BoJ we could well see the market become more receptive to data, with weaker real economy numbers leading to a softer yen as more action from the BoJ is anticipated.

Idea of the Day

We’re currently working on defining the new world order in FX. Carry was the big thing before the global financial crisis (short low-yielding currency, invest in high-yielders), then it was risk-on, risk-off (strong correlation between currencies and other asset classes). Markets are still debating if we’ve moved decisively away from that to a new regime.

On one level, things look similar; with a weaker yen so far this year and a dominant Aussie reflecting the broader risk-on sentiment. But we know with the yen that this has become a lot more volatile and much of this weakness has been down to domestic considerations. Also, the performance of both sterling (weak) and the euro (strong) don’t fit into what one would expect in a typical “risk-on” move.

In broad terms, we’re moving to a world where currencies are becoming more sensitive to domestic fundamentals, something we were picking up on in the closing months of last year. We’ve not yet got a name or strict definition of this new order, but we’re working on it. What it does mean is that the old rules are weakening and there’s more volatility in FX as a result.

Latest FX News

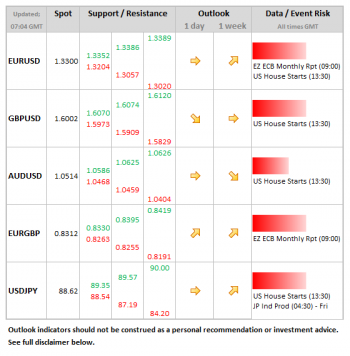

- EUR: Notably steady overnight compared to some of the recent volatility, broadly holding in a 30 pip range vs. the USD.

- JPY: Weakening after two days of gains. For both USDJPY and EURJPY, the broader uptrend remains in place and the focus is moving towards the BoJ next week, where there has to be follow through on the pressure put upon them.

- AUD: The jobs data released overnight proved to be disappointing, with the unemployment rate rising from 5.3% (revised higher) to 5.4%.This knocked the Aussie from 1.0580 down to 1.05. Expectations are creeping in that the RBA could cut rates in the near future.

- CHF: Against the euro, steady just below the 1.24 level. Latest data from the SNB shows expectation of CHF 6bln of annual profit for last year, making CHF 1.4bln on their gold holdings.

Further reading: Swiss Franc – Despite the Peg, USD/CHF Looks Good Technically